A Topic To Bullshit at your Next Family Dinner Table

Jeff's tale of a disappointing new year party that he has experienced. Jeff is shy and has no idea what to talk about but he's working in Crypto. He goes to research and found a good topic to discuss

Backstory

Jeff is a mid-20s year old Thai boi who lives an ordinary life. Jeff is deeply interested in Crypto and has been working in a crypto VC. He lives in Bangkok, leading a normal life deprived of ladyboys, weed, and alcohol.

One morning he is informed by his dad that he has to attend a new year party (that he absolutely dreads) with his relatives (successful uncles & aunties in their 40s and 50s) who he’s not close with.

The smartest uncle who’s the head of the pack of uncles and aunties, the CEO of a conglomerate arrives at the party. After a decade of Jeff hiding behind other uncles & aunties, afraid to strike up a conversation with smart uncle, Jeff decides to talk to him today.

“Hi uncle, how are you?” Jeff goes on to strike up a normal conversation. The conversation takes a sharp turn when smart uncle realizes that Jeff works in Crypto/Web3. “Crypto is scam. Look at what happened with FTX, look at its token that has no real value. There’s BTC that was used to transfer money, now so many tokens, what’s the point?” smart uncle says.

Jeff who’s unprepared for that argument was taken aback and has no idea how to properly respond to that says “FTX is not a good representation of Crypto, it’s a centralized exchange. It doesn’t represent the concept of Crypto and what it stands for” Jeff says. Smart uncle still confuses, Jeff doesn’t know the way to communicate feels like he fails miserably. He goes home crying on the inside, he strives to be more prepared the next time he meets smart uncle.

Jeff goes on the internet and found one narrative that could be a good case study for smart uncle. It’s a narrative that can potentially kick-start the next wave of DeFi adoption, it’s real-world assets

Problems

From Traditional Investors’ Perspectives: Lack of transparency into the quality of the loans packaged for resale. Mortgages are bundled off-chain, tranched off-chain, and marketed off-chain

From DeFi Investors’ Perspectives: Limited access to alternative (more tangible) assets with real-world value. DeFi investors are generally left with investing in tokens, staking & providing liquidity to LPs for projects that do not accrue value

From Real World Assets’ Owners: Limited access to capital (especially for independent contractors & gig economy workers). Asset owners or borrowers are left with borrowing from banks (need to put up collateral) or borrowing from financing companies (high fees & interests)

Jim has Issues

Imagine Jim, your neighbor next door who drives a truck delivering diabetes drinks for Coke. He’s an independent contractor who doesn’t get paid after he delivers the drinks. He gotta wait 90 days because Coke says so. He has no proper credit record nor collateral to go to the bank, so he goes to a financing company that gives him invoice factoring. The catch is he has to pay 40% in fees. He has got no choice but to take that because he has 69 hungry children to feed and has 420 cats to take care.

Now what if Jim can reach into his virtual pocket and get some magic internet money, straight out of internet people who don’t have anything better to do with their money.

Introducing the Solution - Centrifuge

Centrifuge - a technology so cool that anybody would forget about their questions and just stop asking about it entirely

Centrifuge: Enable a DeFi structured money market where transparency exists right down to the individual asset (e.g., title to a piece of commercial real estate) contained in a pool of collateral in the form of NFTs.

But wouldn’t this allow anybody to see private information that borrowers may not be comfortable sharing? (e.g. trade secrets, terms of assets, details of borrowers)

The answer is yah & nah. Centrifuge allows for assets such as invoices & purchase orders to be tokenized and minted as NFTs. Information about the off-chain transactions is provided to an NFT Registry to verify a given set of rules (e.g. verify that you’re a supplier of that invoice). Centrifuge utilizes zero-knowledge proofs capabilities (zkSNARKS) in verifying the aforementioned private information without spilling the beans for everybody. More on this here: https://medium.com/centrifuge/bringing-privacy-to-non-fungible-tokens-a-recap-from-the-zokrates-workshop-at-zcon1-6d9ea8a74b7f

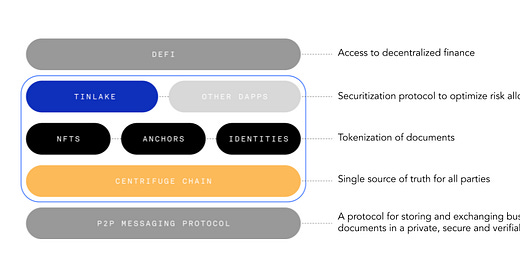

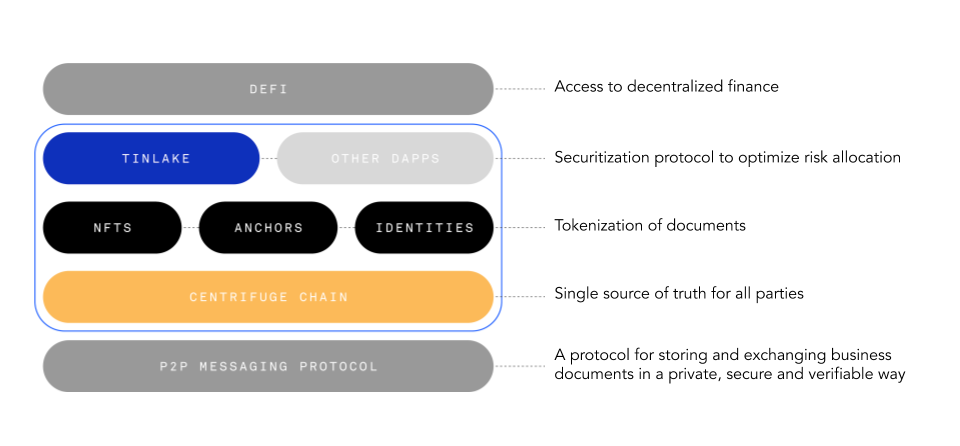

The Centrifuge Stack consists of

P2P Messaging Protocol - store and exchange business documents privately and securely

Centrifuge Chain - hold the unalterable, single source of truth of these documents for all parties. Dapps can build on top of the chain, businesses can tokenize assets and use them as collateral to access DeFi financing

Tinlake - Centrifuge’s securitization protocol for these tokenized assets built on Centrifuge Chain to optimize risk allocation and connect Centrifuge to the DeFi ecosystem

DeFi (not part of the stack) - MakerDAO, a major DeFi lender currently has multiple real-world assets vaults with Centrifuge, deploying over $41m in DAI as of July 2022.

In December 2022, MakerDAO has partnered with BlockTower Capital in deploying over $220m as capital to the pools in Tinlake, making it the largest collateralized, on-chain investment in real-world assets to date

Business Model

Centrifuge generates revenue by originating new fixed-income securities. Whenever a new loan is financed from the pool, the protocol takes 30bps of fees. This fee is taken in DAI which is then converted into CFG on the open market, a portion of the new CFG tokens is then burned and the remainder goes to the CFG Treasury, which is controlled through governance by all CFG holders.

Traction

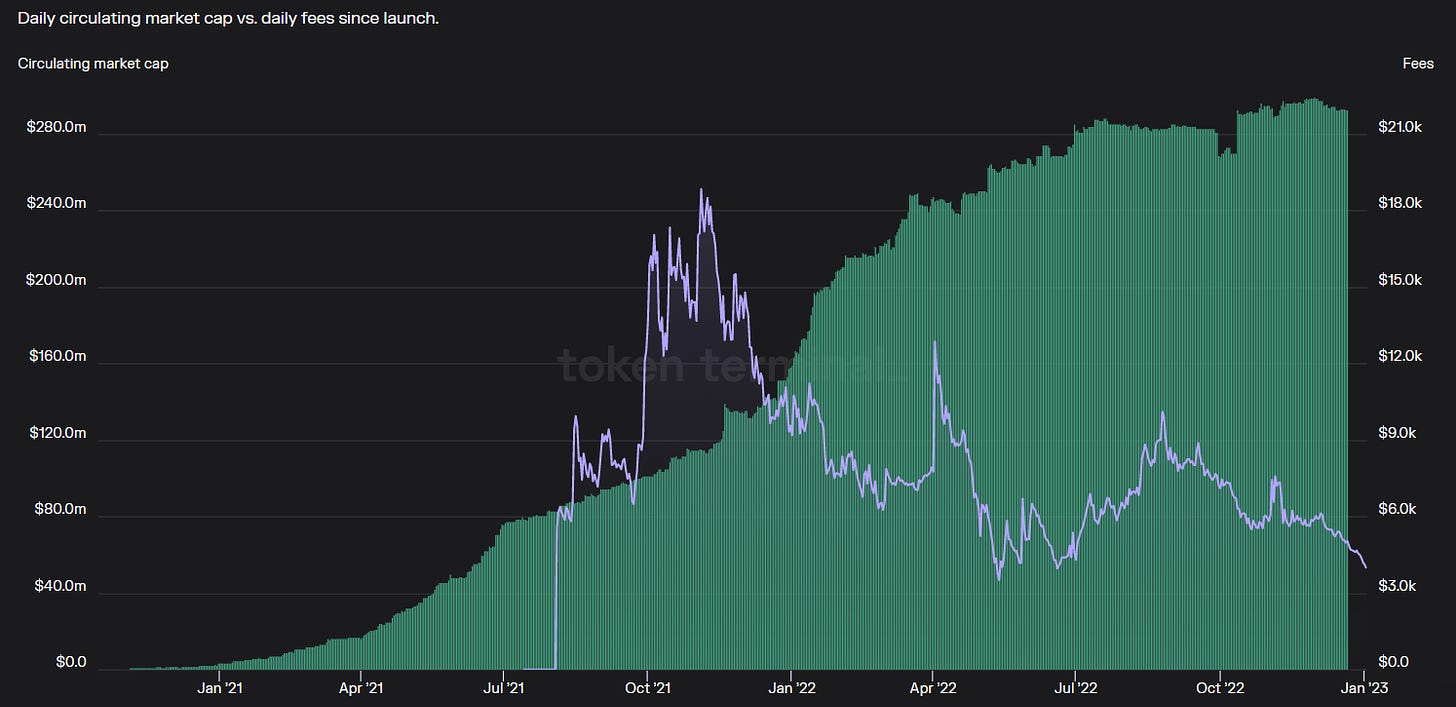

Protocol revenue is equal to the interest paid by asset originators. Tinlake’s monthly revenue has been growing over time as more pools get added to the protocol.

Price action: CFG market cap has sharply fallen from its ATH of $250m to currently ~$53m (Current Price $0.1491, -94.21% down from ATH $25.8) while daily fees generated have been increasing to $22k per day.

Total Value Locked (TVL): $3m down from ATH $9m

Tokenomics

Transaction Fees: Used as transaction fees on the Centrifuge Chain, as more pools get added, more users need to acquire CFG token to be able to utilize the chain.

On-chain Governance and Security

There is a proposal discussing additional utilities for CFG token. If implemented, could make CFG tokenomics more attractive

1/ Turning on protocol fees - servicing fees or borrowing fees denominated in CFG

2/ On-chain Staking: CFG holders to determine which pools to launch

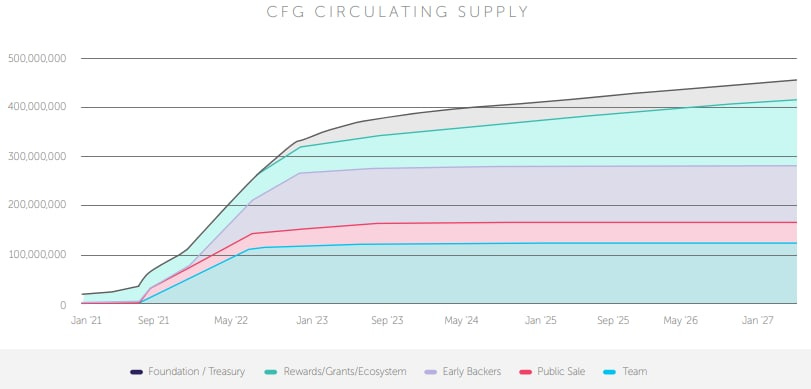

Token Vesting: Over ~84% of CFG unlocked (360m CFG out of 430m CFG based on Coinmarketcap)

Core Contributors - 27% of total supply, 48 months lock up with 12 months cliff. Started unlocking in July 2021

Total Backers - 17.1% of total supply, 48 months lock up with 12 months cliff. Started unlocking in July 2021

Private Sale - 9.5% of total supply, 24 months lock up. Started in July 2021 and ended in July 2023

The rest are rewards and grants

Team

Lucas Vogelsang: Co-founded Swiss eCommerce startup DeinDeal as it’s CTO. After its successful sale, he helped the German startup KaufDA with their international expansion. His next stop was joining Taulia as an Engineering Manager

Martin Quensel: Serial entrepreneur in Fitech, Crypto, and financial supply chain automation. Started his carrer at SAP as Software Developer and Architect. He co-founded Taulia and also worked on invoice processing with Ebydos and ReadSoft

Investors

$15.8m raised across different rounds from investors such as Coinbase Ventures, Rockaway, Fenbushi, Fabric Ventures, Galaxy Digital, IOSG, BlockTower Capital, and so many more.

Source: Crunchbase

Competitions

NAOS Finance: a lending protocol that bridges TradFi and DeFi, allowing real businesses to access liquidity from DeFi without overcollateralization.

How it works: Borrowers collateralize assets off-chain and provide fixed interest payments on-chain. NAOS works with third-party auditors to assess borrowers and establish credit scores based on loan performances.

$0.8m market cap (Current Price $0.01, -99.68% from ATH) | $30k TVL

CredeFi: connects crypto lenders with SME borrowers from the fiat economy

How it works: Works similarly to NAOS finance but seems like CredeFi does credit assessment in-house

$0.15m market cap (Current Price $0.001, -99.24% from ATH) | N.A. TVL

Note: TVL based on Defiillama

Conclusion

Don’t invest in Crypto, it’s a ponzi just like all the currencies in the world. Just kidding.

Now Jeff knows, what to say the next time he meets smart uncle. “Go read this real-world assets use case article on Twitter @Landfsmile”

Thank you everybody who reads this BS. Every like & retweet gets 1 $ETH, JK Jeff too poor for giveaways at the moment