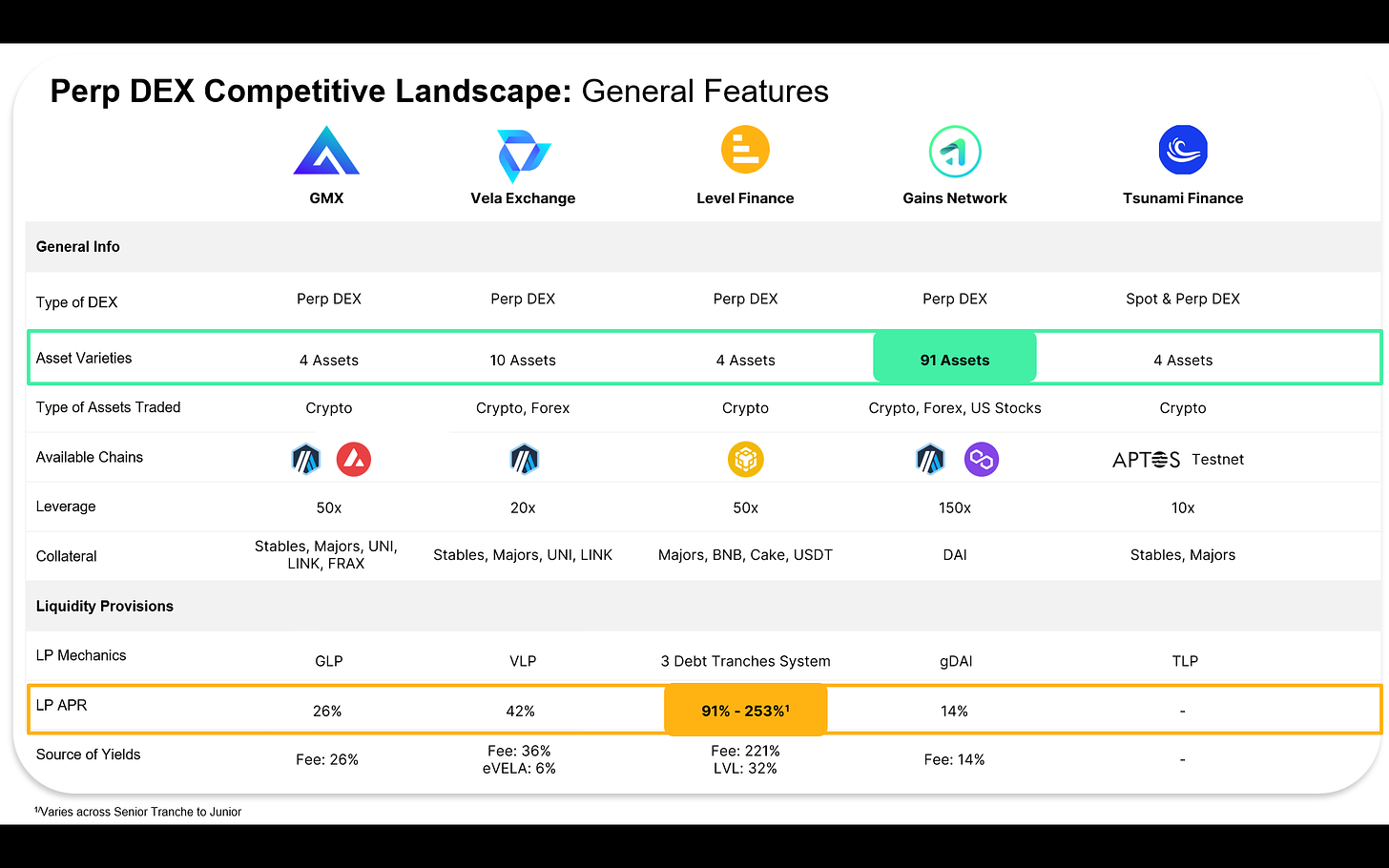

Competitive Landscape Analysis: GMX, VELA, Gains, Level Finance, and Tsunami Finance

Deep Dive into Product Features, Tokenomics, On-Chain Metrics, Valuation, Key Differentiation, Risks and More

Prelude

Crypto Perpetual / Derivatives Market is a Multi-Trillion Dollars Market with Centralized Exchanges such as Binance, Bybit, OKX, and Bitget dominating the market.

In 2022, we have seen a great shift in user behavior - from using CEX to trade Spot & Perps to purely using DEX. This is spurred by the fact that FTX, which used to be a top-3 Crypto giant, collapsed within a week, causing shockwaves across the entire industry. The phrase “Not your keys, not your Crypto” has never been more true.

The Rise of GMX

The shift in user behavior gave rise to GMX which provides swap and margin trading with zero slippage by letting users trade against the GLP pool. GLP is a basket of assets that consist of Stablecoins (USDC, USDT, DAI), wBTC, ETH, LINK, and UNI.

GLP is a single sided liquidity pool without impermanent loss that acts as a counterparty of every trade executed on GMX. GLP holders earn 70% of platform fees with escrowed GMX rewards while GMX stakers earn 30% of the platform fees with escrowed GMX and Multiplier Points (which boost the yield, the longer you stake).

GLP-GMX innovation continues to be used by many protocols e.g. Vela Exchange - Perp DEX with VLP-VELA and JustBet - Decentralized Betting Platform with WLP-WINR. The GLP innovation improves capital efficiency due to the high asset utilization of the GLP pool, which lets user deposits generate extra yield and not sit idle.

GLP on Steroids

With the invention of GLP, protocols started creating investing vaults that utilize GLP and its yields to generate extra yields or to generate risk-adjusted yields. One of the earlier example is Jones DAO Leveraged Delta GLP Vault which generates additional return from using the deposited tokens to borrow USDC to generate more yields within certain risk parameters.

Now to the Fun Part - Ze Competition

Since GMX came to prominence, other Perp DEX protocols follow suit. Vela Exchange utilized its second mover advantage by looking at the pain points experienced by GMX traders - the lack of TP & SL functionalities.

Vela Exchange implements TP & SL features, allowing traders to set Trailing TP & SL levels before making a trade as well as allowing Stop Market & Stop Limit orders. Vela executed great GTM strategies, bootstrapping POL with its Hyper VLP campaign, offering boosted esVELA rewards & High APR to early users who mint & stake their VLP.

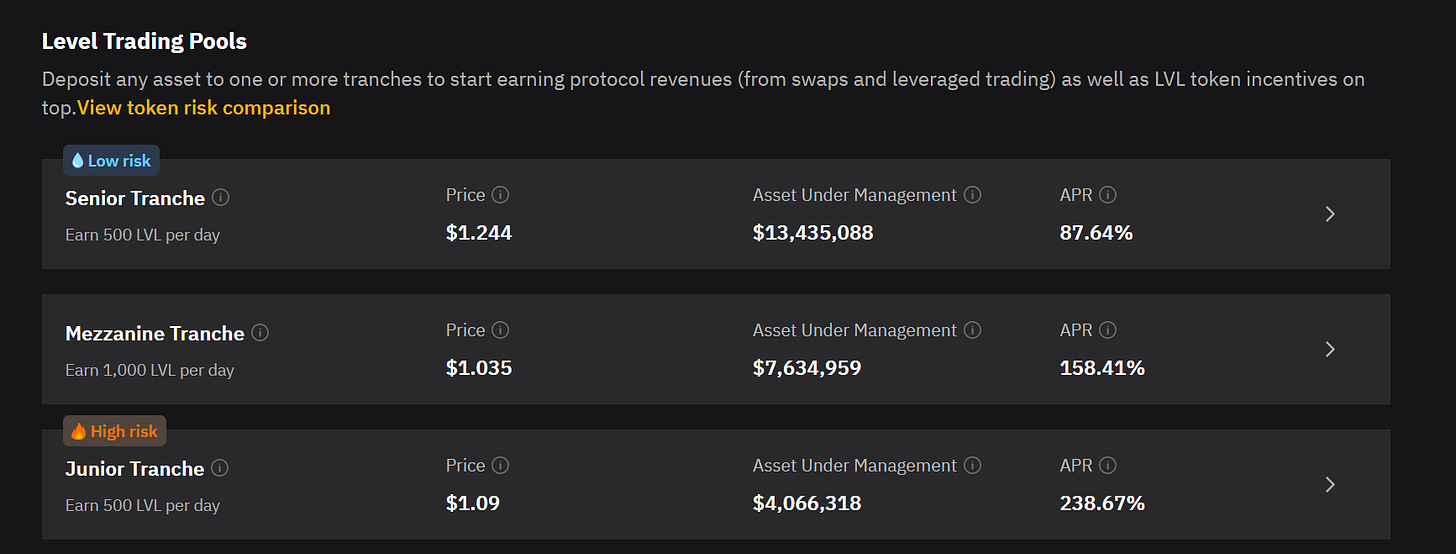

Level Finance came up with Three Debt Tranche Risk Management System, each of the tranche with different risk levels & interest rates. Senior Tranche (AAA), Mezzanine Tranche (AA), and Junior Tranche (BB) which bear the highest risks from riskier assets such as BNB and CAKE. Level Finance currently provides APR of 91% - 253% to their Tranches LPs and Yes - Majority of these yields are Real Yields (We’ll get to that debate in a bit whether this is really Real Yields or Nah)

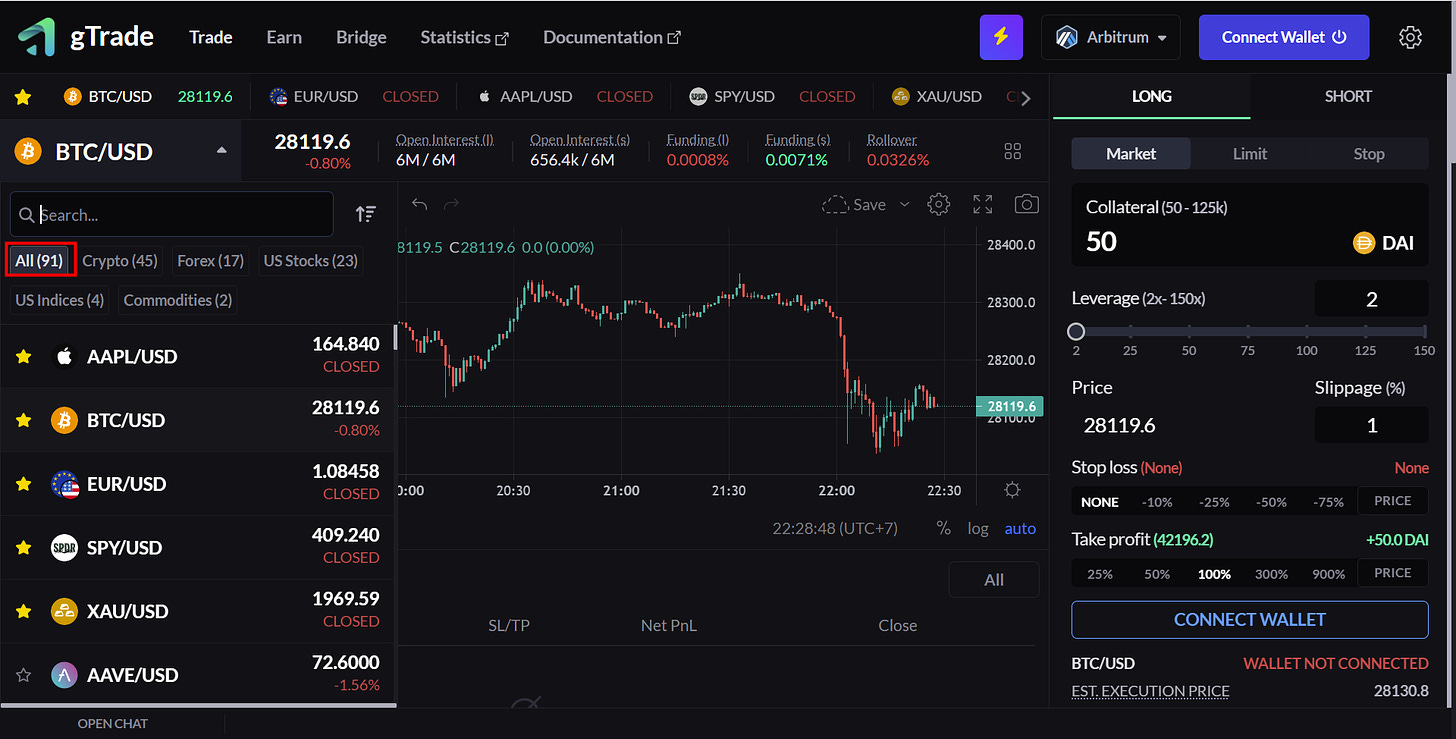

Gains Network differentiates itself by positioning as the Perp DEX platform that enables traders to trade over 91+ Assets from Crypto, Forex, and US Stocks. Gains allows you to leverage your tits to the max 150x leverage!!!

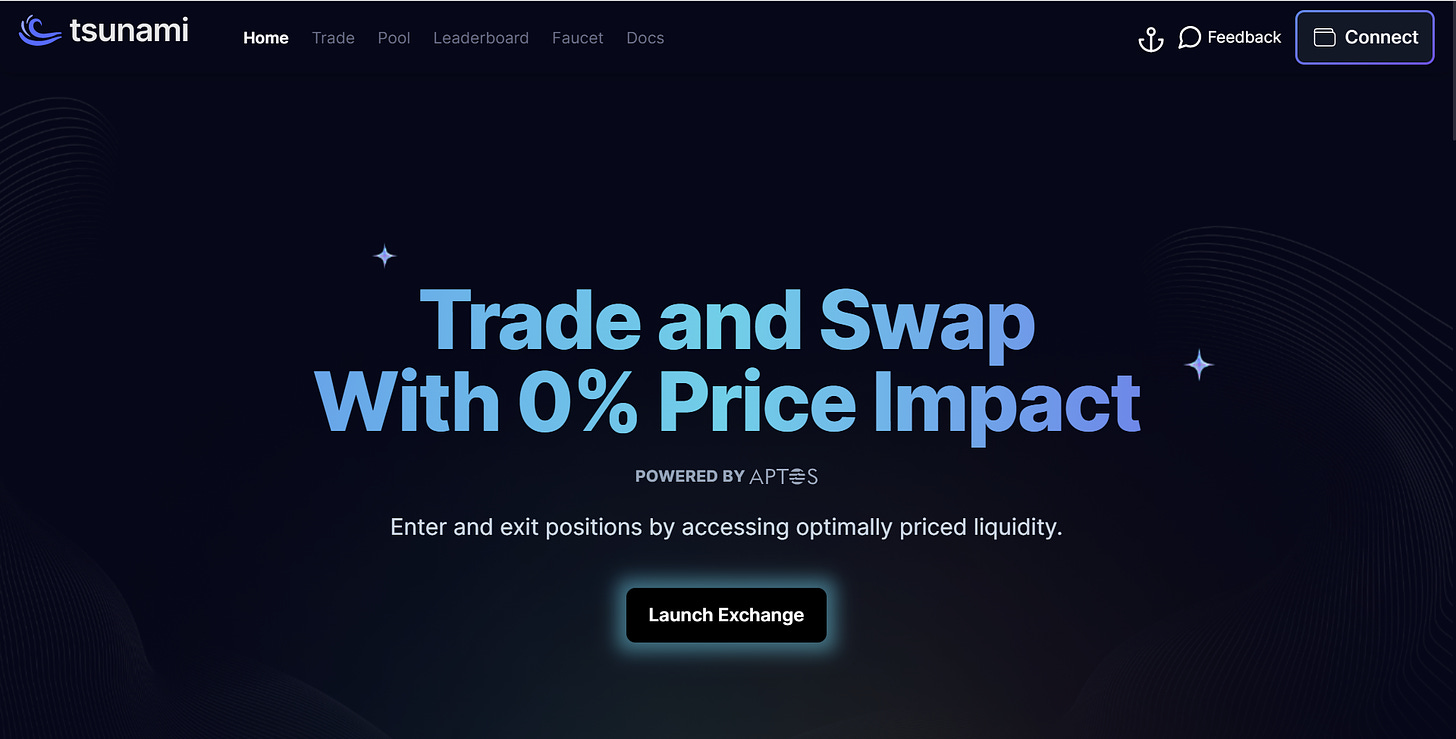

Tsunami Finance follows suits with GMX-GLP innovation with its NAMI-TLP right on Aptos Chain. Tsunami plans to go a step further by introducing Risk-Adjusted Pools, enabling traders to have access to a wider range of assets by offering multiple versions of TLP with varying risk and reward mechanisms in order to facilitate the trading of long-tail assets without compromising the core pool. Tsunami also plans to go cross-chain Swaps & Perps as well as allowing cross-chain market lending.

Now Out of These Perp DEXes, GMX & Vela for me feels the smoothest for me in term of trading experience as these protocols are on Arbitrum. Everything is fast and the UI/UX are top-tier

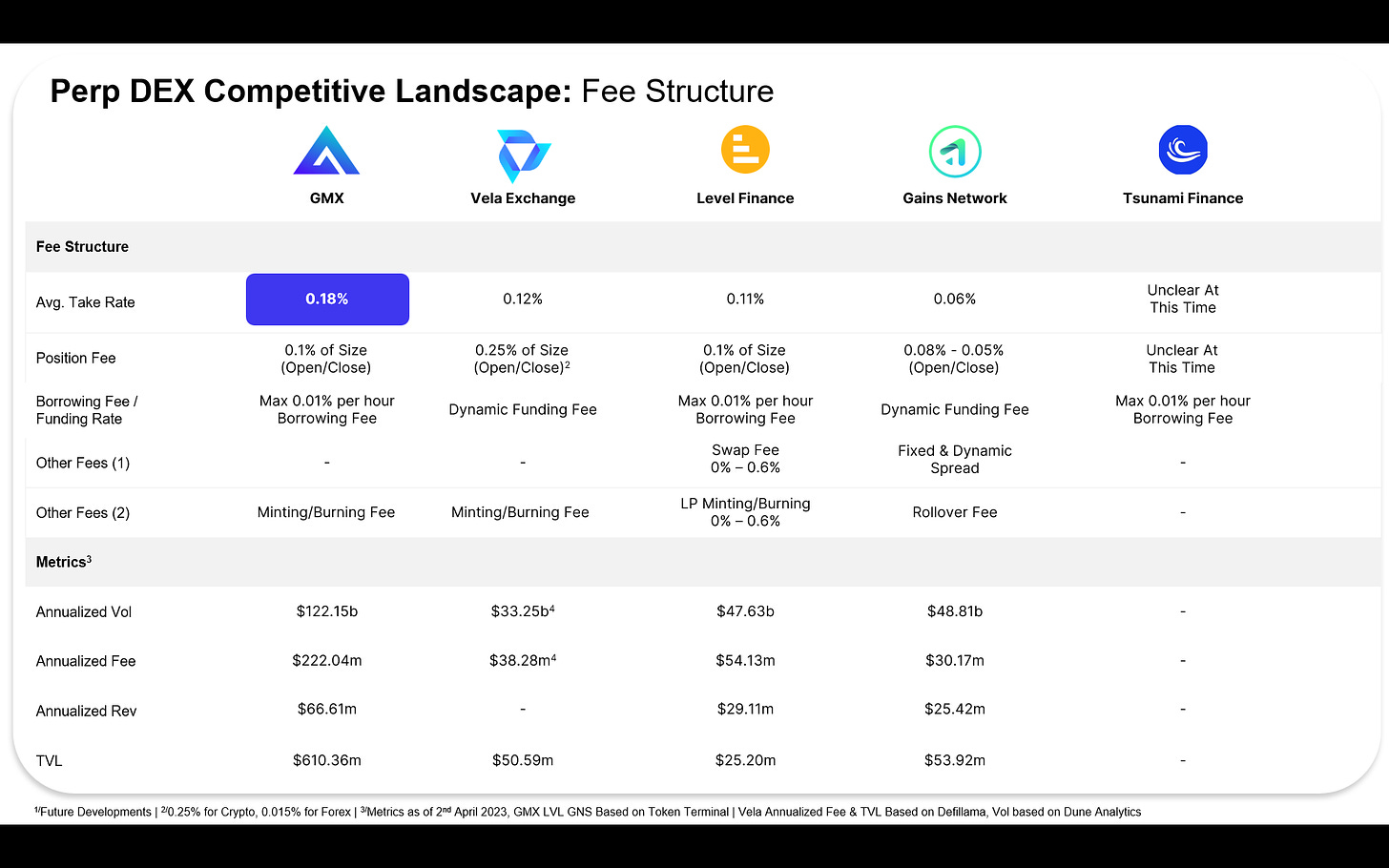

The Fee Structure

Perp DEX business model is fairly simple, main revenue streams come from

1/ Position Fee - paid when Opening & Closing positions

2/ Borrowing Fee or Funding Rate - varies, paid on a per hour basis on the amount borrowed for margin trading

GMX generates the highest average take rate of 0.18% due to its growing borrowing fee from increasing Open Interests - based on the last 30 days fees, GMX is expected to generate more than $222.04m in annual fee

Vela came second at 0.12% average take rate while Level Finance came second at the second highest annualized fee of $54.13m. Level Finance charges Swap Fee and LP Minting/Burning Fee on top of its Position Fee & Funding Rate.

Gains Network charges Fixed & Dynamic Spread based on different risk & different type of assets - higher spreads for Forex & US Stocks Synthetics.

The Tokenomics

GMX - GLP stakers get 70% of protocol fees, 30% goes to GMX

Vela - VLP stakers get 60% of protocol fees, 25% goes to Treasury and 15% goes to VELA stakers. Parts of Treasury used to initiate Buyback and Distribute of VELA

Level Finance - LVL stakers get 10%, LGO stakers get 10%, LLP (Tranches) get 45%, DAO Treasury 30% and 5% for future development. DAO Treasury revenue used to earn yields and distributed to LGO stakers. LGO is the governance token that can only be earned from staking LVL.

Dutch Auctions: Providing more utility to LVL, increasing yield participation, and further deepening protocol and LVL liquidity.

Acquire LVL Tokens from DAO Treasury with USDT

25% of proceeds will be paired with LVL from the treasury to create a new LVL/USDT liquidity pool

75% of X$ will be added to the Senior tranche

Burn LVL to acquire LGO, and gain access to the LEVEL DAO

Positive price action for LVL (Increase demand / Reduce Supply for LVL)

There’s also an Anti-Dilution Measure put in place to make sure that LGO does not get diluted

Loyalty Program: Incentivize and reward trading activity via LEVEL loyalty tokens (lyLVL), based on the size (USD volume) of their swaps and closed trading positions. LyLVL can then be converted for LVL tokens after a 24h vesting period.

A total of 16,000 LVL per day are allocated for traders on the LEVEL DEX.

This equals to approx. 11.68% of inflation provided in a year

A lot of Volume & Fees driven to Level Finance comes from this Loyalty Program - Several traders continue trading on loss to farm for LVL rewards from the program

Token Distribution & Multiples Analysis

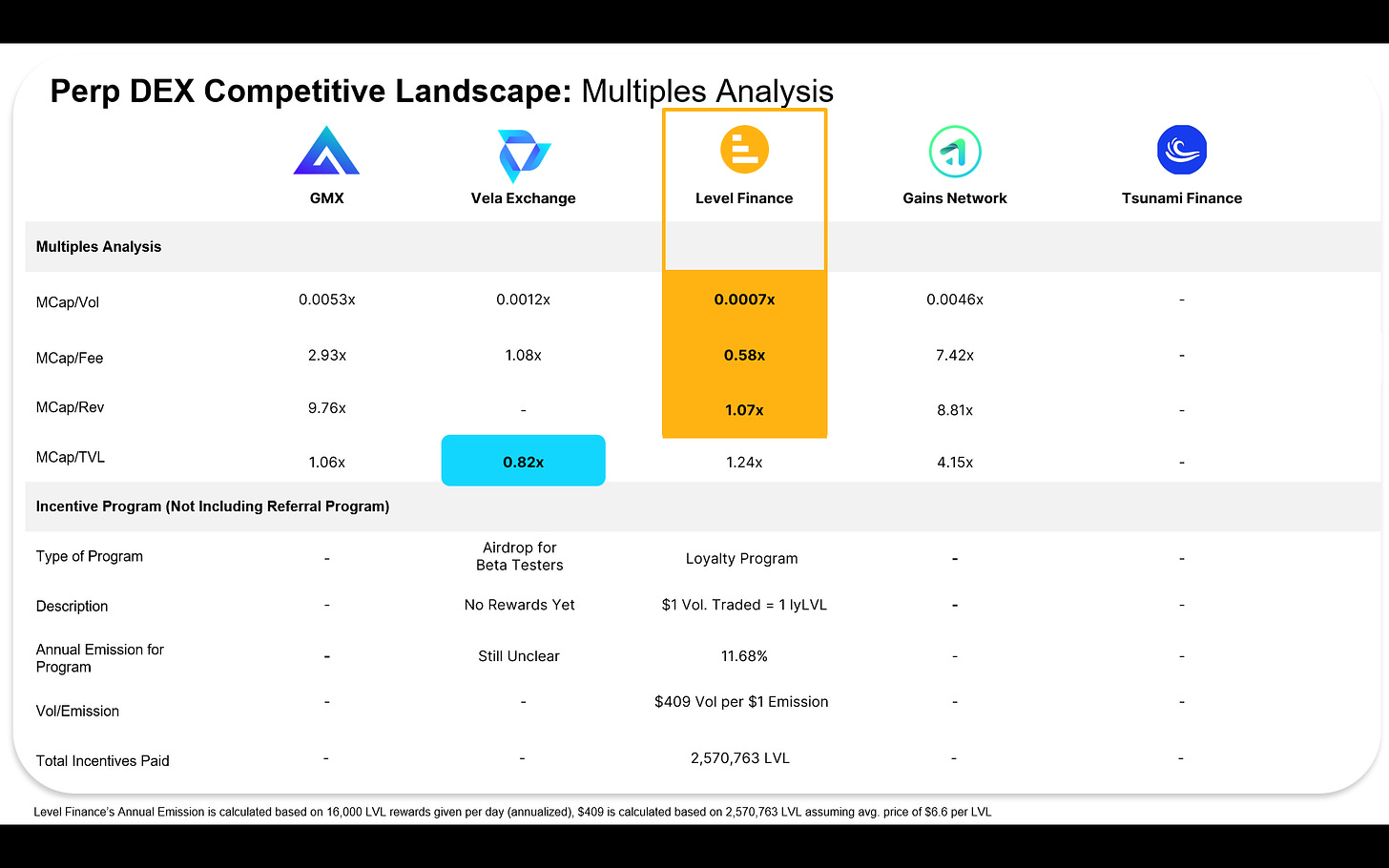

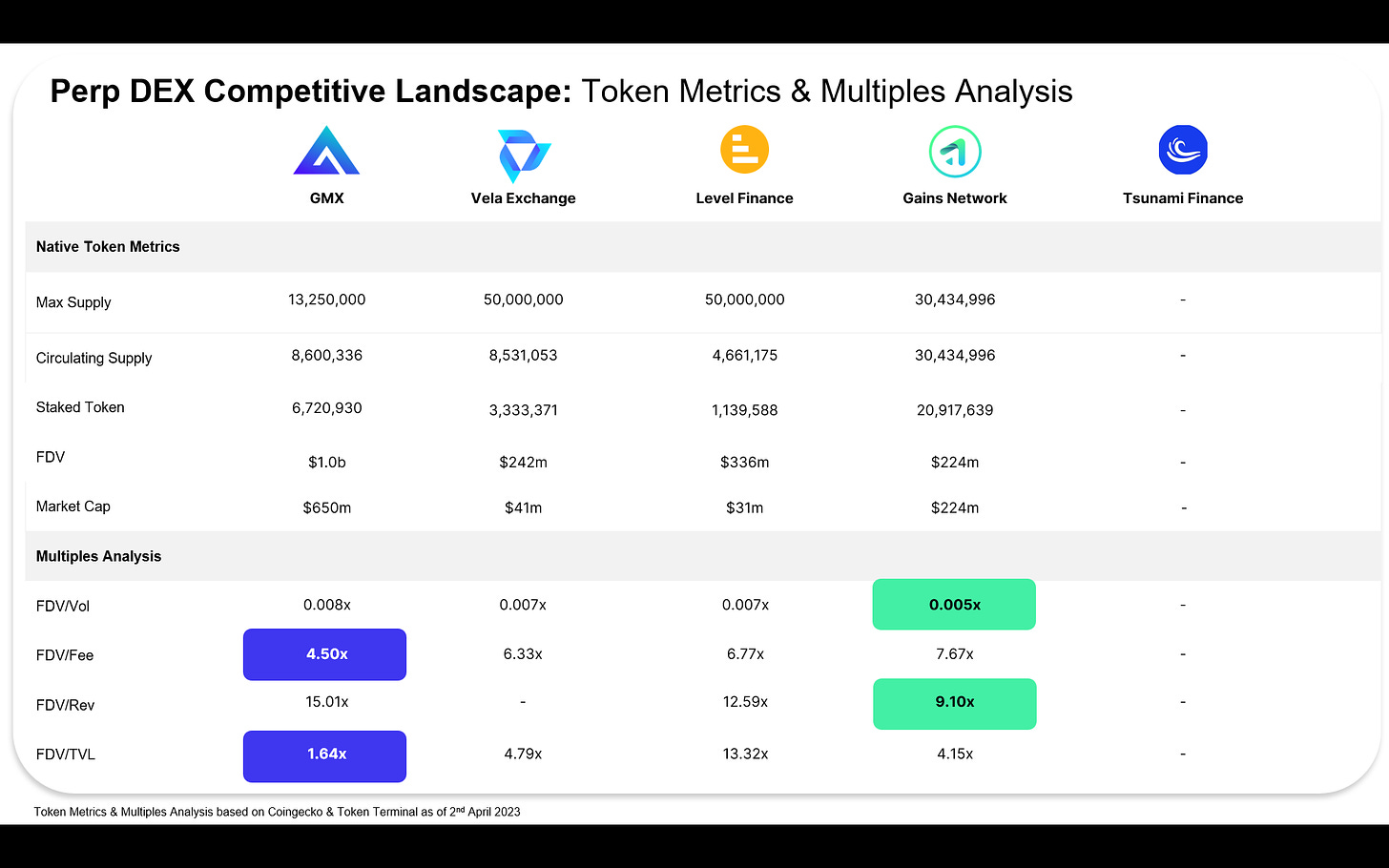

In term of Token Distribution, Vela Exchange & Level Finance % Circulating Supply is still relatively low compared to GMX & Gains Network.

Vela Exchange attributes ~50% of Max Supply to Community Incentives & Growth. Out of 50%, 30% is reserved for LP reward emissions, market-making and platform liquidity rewards, beta test rewards, and other incentives.

Level Finance goes a step further, attributing ~70% to Incentives with 36% for Liquidity Providers and 34% for Community Incentives. Level is taking a different approach to other peers, focusing on Incentivizing Volume with LVL emissions through the Loyalty Program - The effect of this is very intriguing

Volume, Fee, Revenue grow extremely fast compared to its Market Cap

For every $1 in LVL incentives, $409+ Vol is attracted which equates to around $0.44+ of revenue per $1 incentives

Level Finance - Market Cap Multiples of Level Finance is highly undervalued compared to its peers due to the emissions from the Loyalty Program

Vela Exchange - Market Cap to TVL of Vela shows that Vela is undervalued compare to its peers. This is due to the initial Hyper VLP & High VLP incentives that Vela provides to the liquidity providers. Early liquidity providers were getting 80-200% APR in additional esVELA rewards on top of the fees sharing.

GMX - Top Perp DEX in term of FDV & Market Cap, Over 65%+ of Supply is Circulating. Best Multiples for FDV/Fee & FDV/TVL, generating decent GMX-GLP returns from its high Real Yields fees derived from trading volume

Gains Network - Top Perp DEX for FDV/Vol and FDV/Rev as GNS has the lowest FDV out of all its peers.

Risks

Oracle Manipulation - GMX and other Perp DEXes facilitate traders with 0 slippage, and LPs with no impermanent loss by using Chainlink price feeds fetched from multiple Centralized Exchanges, especially on pairs with low liquidity on CEX.

This happened to GMX on AVAX/USD pair, the traders moved the price in their favors with large long & short positions, moving the oracle price in their favors and extracting profits from GLP liquidity providers on GMX. Since then, the team capped the short and long-open interest for AVAX and the GLP and GMX markets continue to operate normally.

Counter Party Risks - GLP-type Liquidity Provisioning can be perceived as owning shares of a casino. Traders’ losses are GLP profits, and traders’ profits are GLP losses. If traders keep on winning, GLP will keep getting drained. This is not empirically true as Traders’ cumulative losses tend to offset those sporadic big gains from some traders. GLP works as intended, in view of its performance during LUNA and FTX incidents.

CT Coverage & Hype

Vela Exchange is getting well covered since its successful alpha & beta tests. The potential testing airdrop, attracts both testers and traders alike to trade on the platform. This coupled with Hyper VLP incentives, and ambassador programs have got CT talking about Vela as the next Top Perp DEX on Arbitrum.

Level Finance is starting to pick up some steam on CT as the protocol utilizes a flywheel that’s pretty different than other Perp DEXes. This along with the High APY from providing liquidity on the Three Debt Tranches System, and Loyalty Program have got LPers and Traders interested in interacting with the protocol.

Catalysts

GMX v2 is coming - there’ll be an update to the GMX interface codebase, updated fee parameters to the v2 contracts. V2 handles a more robust set of parameters when creating markets which ultimately could lead to lower fees and more efficient markets. GMX also plans to expand the varieties of assets traded on platform, onboarding synthetics assets.

Suggested Improvements

Tokenomics - I’m personally liking what Level Finance has brought to the table in term of Loyalty Program & Dutch Auction which contributes to the accruing value of LGO (Governance token) and increasing trading volume on platform.

Would love to see more incentives driven campaign being done on GMX, Vela and other Perp DEXes. Level Finance flywheel kinda reminds me of Solidly ve(3,3). If escrowed or veTokenomics could be introduced alongside the Loyalty Program, that could curb selling pressure, improve the token price discovery, further incentivizing long-term protocol supporters

Features - More CEX-like trading features should be introduced to more Perp DEXes, trailing stop losses & trailing take profits, Quick & Intuitive 25% 50% 75% 100% TP & SL buttons, gauge sliders for TP & SL, etc.

Partnerships - More partnerships to lending/borrowing platform, DeFi Middleware, Options/Investing Vaults would bring more use cases to the protocol and to the liquidity (GLP, VLP, etc). Enabling more use cases, thereby increasing the overall demand for the protocol.

Parting Thoughts

Buy VELA please, Pamp me Bags - Just kidding. Great write overall, hope you’ve found this a good read and a helpful primer to the Perp DEX Competitive Landscape.

Thank you for having read my article. If you like it, please follow me on my Twitter (@LandfSmile) and tell me how I can improve my content. Here’s a 🥔

What does CT represent as in CT Coverage above? And agree, great article and much appreciate the details. You’ve taught me much!

Bro - Great article. Where did you get the presentation and data from ?