Deep Dive Analysis on CamelotDEX $GRAIL

Camelot History, Product Features, On-chain Metrics, Multiple Analysis, Sentiment, Catalysts, and much more

TL;DR

There are 3 main reasons why $GRAIL is poised for growth

Arbitrum Ecosystem continual TVL, DAU, Price growth and the overall bullishness of the Ecosystem

Strong Catalyst for Concentrated Liquidity AMMs

CamelotDEX Positioning as the #1 Liquidity Hub on Arbitrum

Prelude - How Camelot DEX Came to be

Before Camelot DEX there was Excalibur Exchange - At the height of Fantom Bull in early 2022, when Adam Cochran Shopping List went viral and Solidly & Solidex first came out, Excalibur Exchange garnered over $45m+ in TVL at its peak. The TVL slowly died down as the market trended lower due to all the crashes that were happening last year. The team decided to branch out to Arbitrum and rebrand the DEX under Camelot DEX

Camelot DEX conducted a fair launch in December 2022 with Market Cap of $5.7M and $GRAIL price of $254 → Today the price has gone up 10x to $2,500 with ATH at $4,500 in March. Camelot has successfully established itself as the #1 Liquidity Hub in Arbitrum BUT it has done so not without challenges and perils along the way

The Rise of Camelot

Camelot came to prominence in January 2023, when the overall macro was improving, inflation was starting to tone down and Arbitrum was starting to get more traction due to its fast & cheap transaction from the Arbitrum Nitro Upgrade last year. This coupled with the fact that there’s a rumor for Arb token airdrop and that multiple DeFi projects decided to start building or migrated to Arbitrum, has attracted fund flow from other ecosystem.

During the time, Defi Infrastructure on Arbitrum was in its early innings - there was a space to be filled for native DEX since the main DEXs that established itself on Arbitrum were major ones like Uniswap & Sushiswap. Camelot saw the opportunity and started establishing great relationships with major Defi protocols that are building on Arbitrum

Everyday a new Knight is added to the Round Table (it’s what they call protocol that Camelot has partnered with) and every protocol that is listed or launched on Camelot would appreciate in price. In part due to Camelot’s strong BD team, flexible LP pools / non-fungible liquidity positions that grant flexibility for both partnered projects and the LPers, great launchpad functionalities (for new projects looking to launch), and the community effect that’s starting to take shape

The Perils of Camelot

After having established itself and accumulated early traction during January, more protocols looking to launch on Arbitrum were starting to look at Camelot as the #1 Liquidity Hub and #1 Launchpad. Several projects started launching on Camelot utilizing the same fair launch format (without hard cap) that was used with GRAIL & NEU launch.

Fair launch without hard cap allows for anybody to participate in the sales. This drives up the Valuation (FDV) of the projects to an extremely overvalued valuation, which is not good for the project at all as these projects often do not have their products ready yet → Ludicrous Valuation + Pre-Product Stage Projects = Disaster. As seen in NitroCartel & FactorDAO which have raised $14M and $7M off of fair launch respectively without even a Minimum Viable Product (MVP) out

With the failure of these projects, skepticism started forming within the community, and price action started to reflect the overall sentiment - price declined from $3,000 to $1,500 within a few weeks

Camelot Rising from the Ashes

Within a few weeks after the overhyped launches of NitroCartel & FactorDAO, the Camelot team changed the launch format to be hard cap & WL launch, granting additional utility to xGRAIL stakers with the launchpad plugin

xGRAIL stakers can choose to allocate their xGRAIL to the launchpad in exchange for WL allocations for particular projects launching on the launchpad. The change in launch coupled with the rise in TVL, and the increase in activity in the market has propelled the price of GRAIL to the north of $4,500

The price has gradually tapered off and fluctuated upon the launch of Arb token and continued to decline due to the overall Arbitrum Foundation DAO AIP-1 Mishap BUT things are about to change 👀

Product Features

Before we talk about the catalyst, let’s touch on the things that crystalize Camelot as the #1 Liquidity Hub on Arbitrum - Camelot’s AMMs & Liquidity Provisions

Camelot’s v2 AMM

Ecosystem-oriented approach, designed with the following principles in mind:

A high level of flexibility and customization

An optimized trading efficiency for users

Providing support to protocols' growth by adapting to their needs

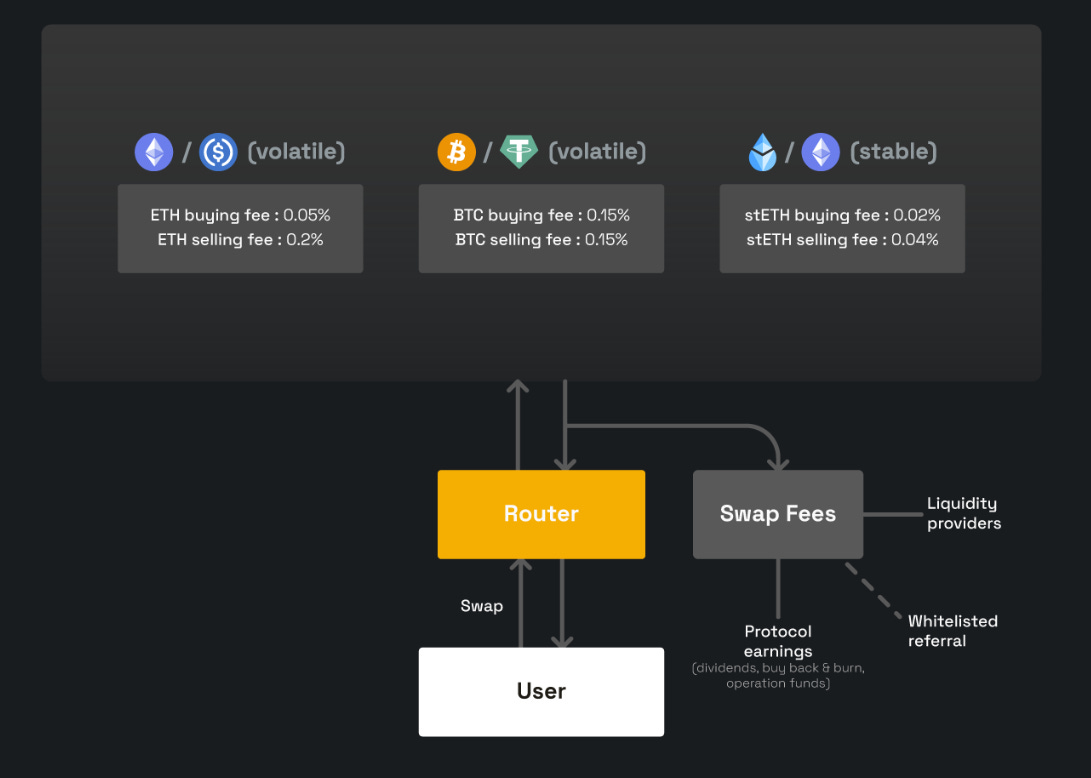

→ Dual liquidity type utilizing Uniswap v2 for volatile pairs & Solidly curve for stable pairs which allows for efficient stable swaps and

→ Dynamic directional fees, swap fees adjustable by partnering protocols with the flexibility to adjust on both directions (buying and selling)

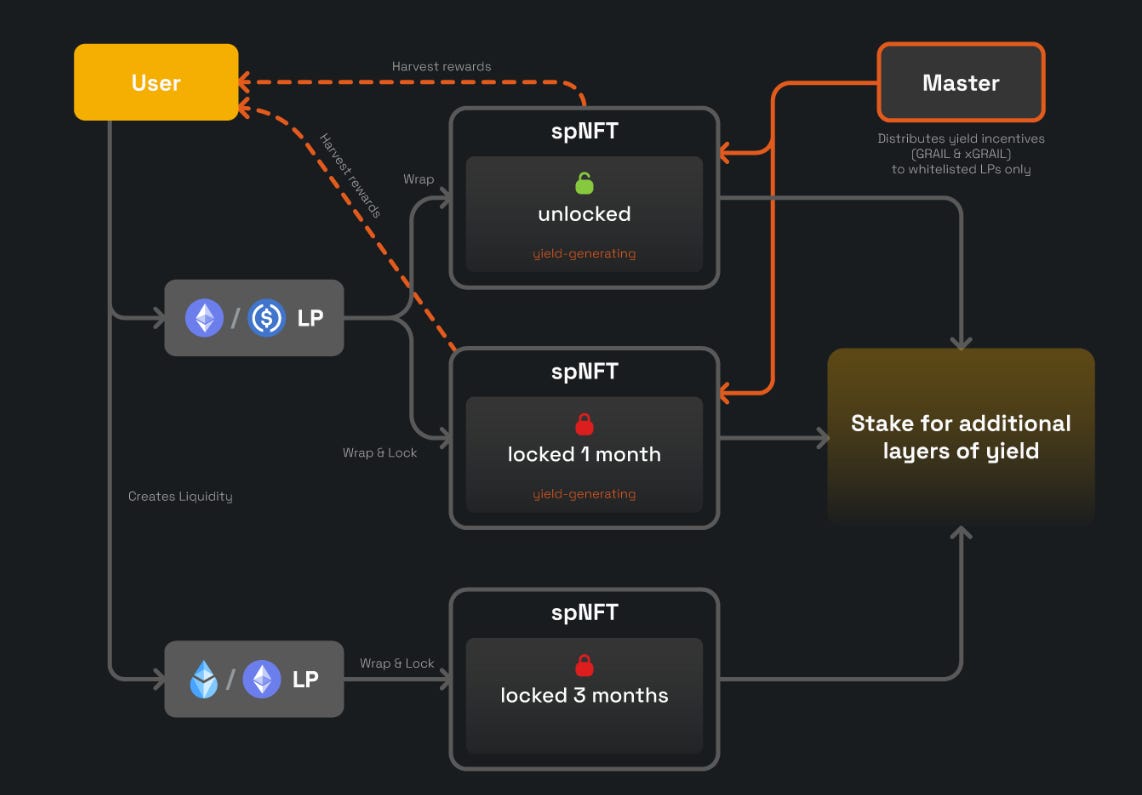

→ Staked positions NFTs, wrapping LP tokens to mint spNFT positions. The spNFT positions allows for additional layer of flexibility - as duration of the LP lock, APY, harvest optionality, lock multiplier, yield boost multiplier can be tinkered according to the user needs.

Users can create advanced custom strategies through an unlimited number of different staked positions for the same LP, with different amounts, locks settings, or boosts mechanics.

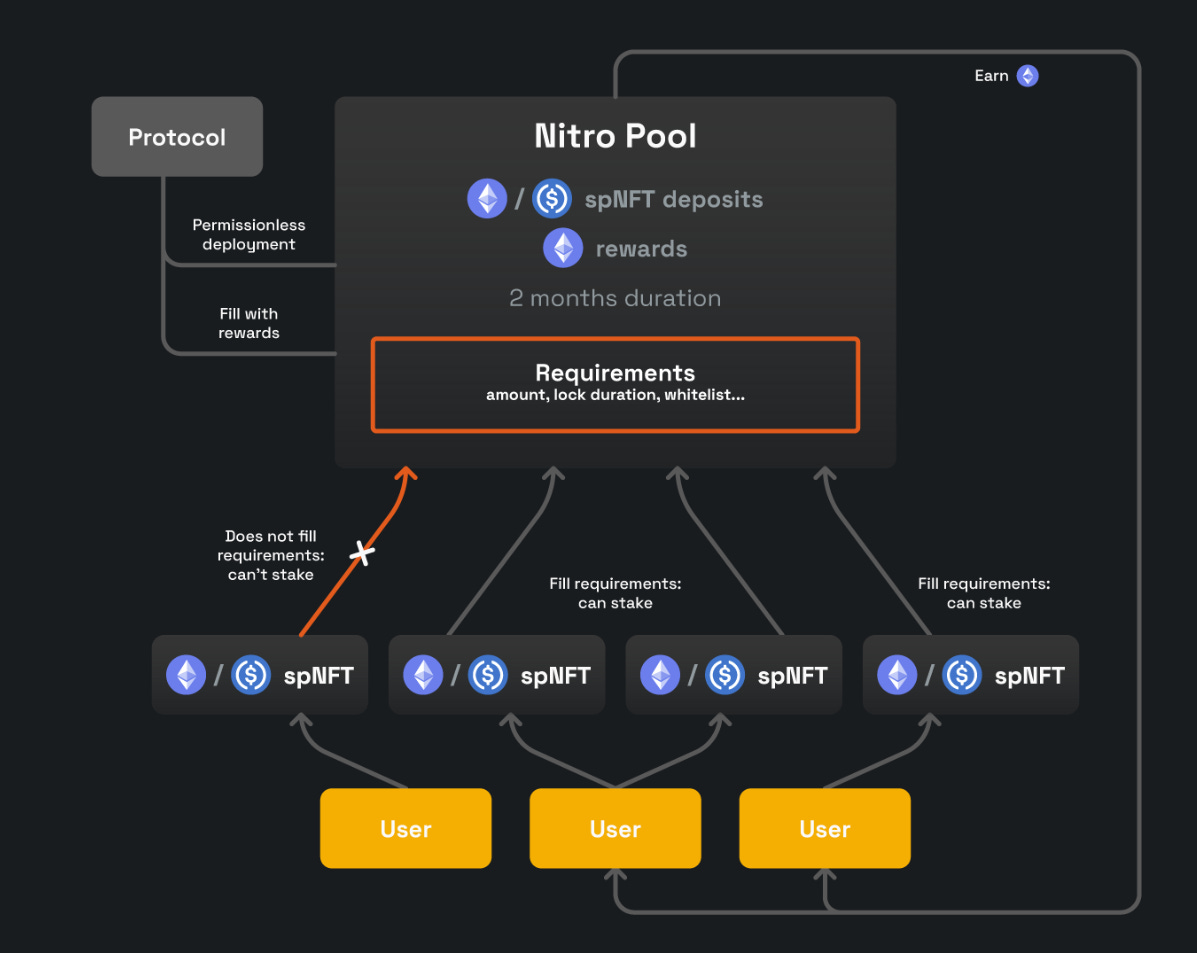

→ Nitro Pools, fixed duration pools that allows protocols to incentivize their liquidity without any need for intermediaries, adding a set of requirements, providing projects a unique ability of targeting the precise staking user's profile that they want to reward, or to focus incentives on a certain type of liquidity

Tokenomics

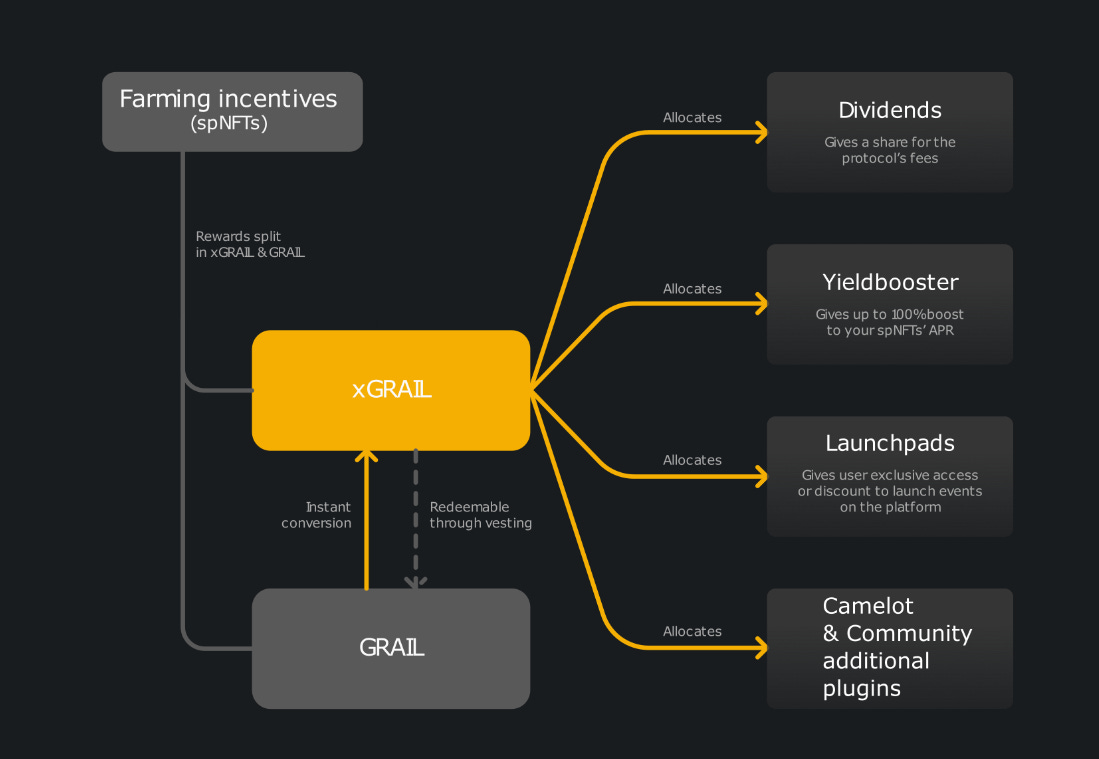

Majority of the GRAIL emissions are rewarded in the form of xGRAIL (staked version of GRAIL) - xGRAIL can be used across different “plugins” where users can choose to allocate their xGRAIL to the plugins that best benefits them

Dividends Plugin - participate in a share of protocol fees (22.5% of swap fees)

YieldBooster Plugin - Up to 100% boost to spNFT APR

Launchpad Plugin - WL, Allocations, and other perks to projects launches

Additional Plugin

xGRAIL needs to be vested if one wants to convert to GRAIL (Minimum 15 days to 6 months of vesting)

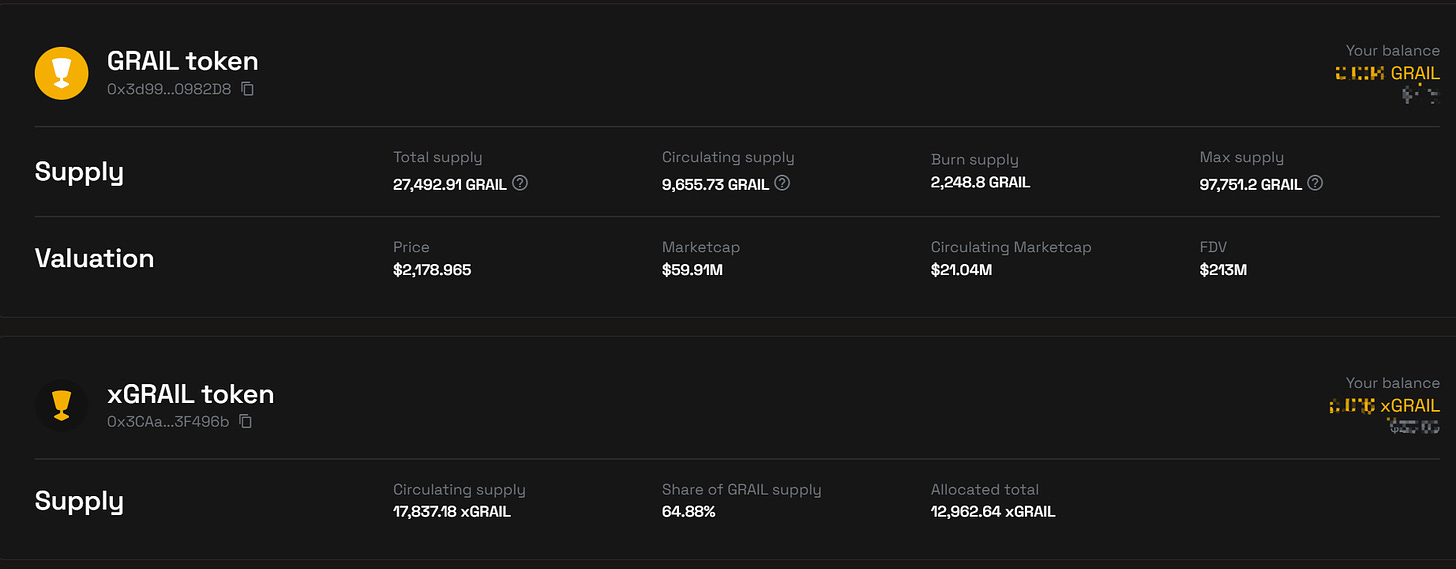

The vesting tokenomics plus the plugins incentives help curb the selling pressure, while parts of the swap fees (12.5%) are used to execute buyback & burn of $GRAIL, and penalties from early xGRAIL vesting (<6 months) are also burnt - so far more than 2.2% of the total supply is burnt, and majority of circulating supply are in xGRAIL (64.88% of the total supply)

Tokenomics Vesting & Distribution

30% Genesis → 15% Public Sale, 5% Genesis Pools, 10% POL

22% Core Contributors & Advisors → Vested linearly 3 years

The rest if used for partnerships and ecosystem developments

No large unlocks but the start of Partnerships (10%) 2-year linear vesting will start around next month

However, Key Risks are

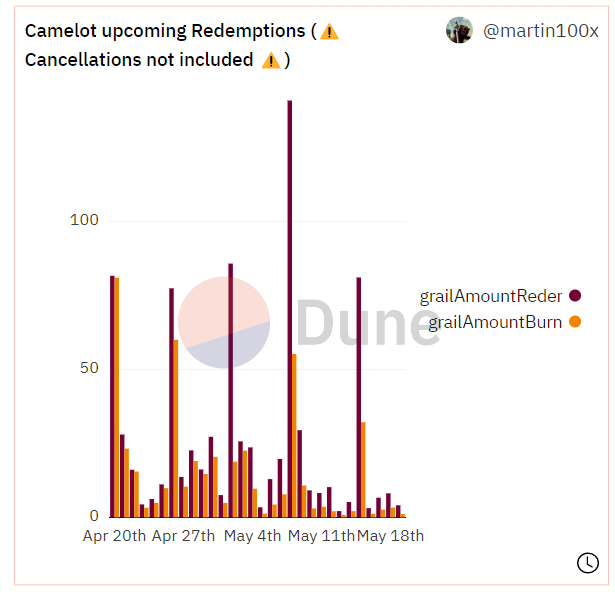

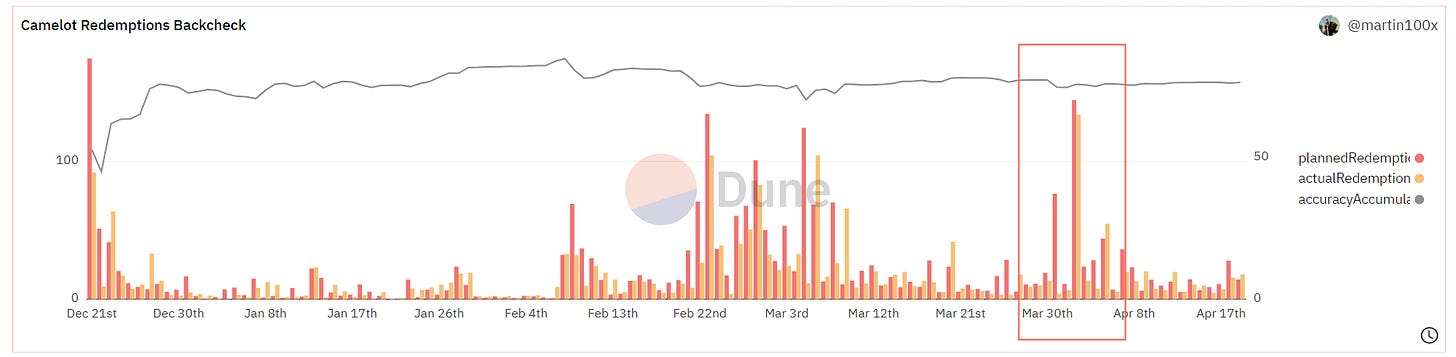

Large Redemptions in May which could drive the price lower if Macro / BTC-ETH continues crabbing

GRAIL Price fell down by roughly 20% in a week (from $3,000 to $3,300) after the last large redemptions during early April

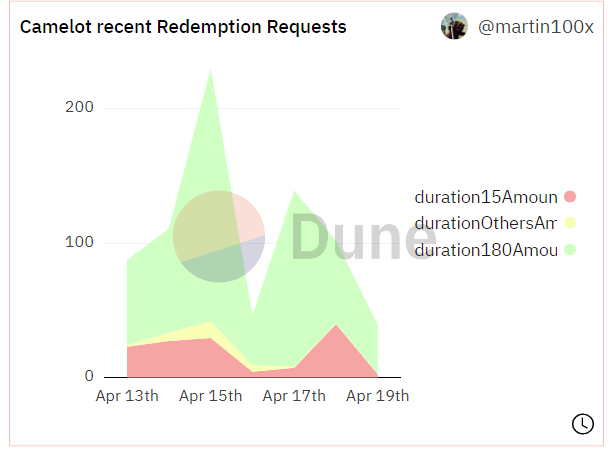

Following the large redemptions, large redemption requests ensue since the start of April 2023. This is in tandem with the first wave of xGRAIL stakers going through the 30 days launchpad plugin unlock (xGRAIL allocated to the launch plugin had to undergo 30 days lock)

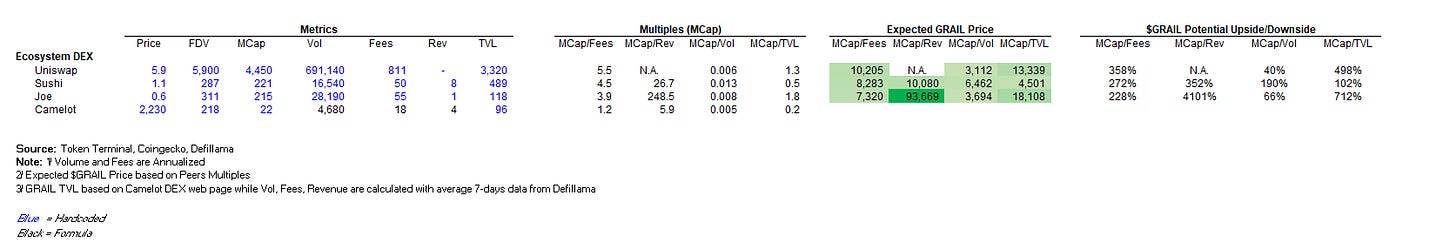

Multiples Analysis

Comparing Market Cap Multiples of $GRAIL to the leading DEXs on Arbitrum (Uniswap, Sushi, Joe) makes $GRAIL extremely undervalued as majority of circulating supply (64.88% of total supply) is in the form of xGRAIL

Market Cap to Fees, Revenue, Volume, and TVL show that the Indicative $GRAIL Price should be ranging from $3,112 to $18,108 (Neglecting $93,669 as an outlier) with a median of $7,802

Market Cap to Volume would likely be the most meaningful multiples to look at. The MCap/Vol multiples show that the indicative $GRAIL price is $3,112 - $6,462, boasting a potential upside of 40% - 190%

Disclaimer: The reason why Market Cap is chosen to be used instead of FDV is because of the fact that $GRAIL utilizes xGRAIL tokenomics with long lock up periods. The effect of lockups should be taken into account for the valuation analysis

Technical Analysis

$GRAIL retraced back to $2,100 support level since yesterday BTC dump. $GRAIL is grinding up nicely towards $2,500 resistance level which serves as both great resistance and support level based on VPVR. RSI briefly touched the oversold region and is currently bouncing back

Both VPVR, RSI, and support level indicate that they current price point could be great level to start DCA’ing in

One could start to take partial profits once $GRAIL has reclaimed its $3,100 level

Sentiment & Catalysts

The sentiment on Arbitrum has started to improve again since the Airbitrum Foundation AIP-1 mishap, the foundation continues to be more transparent and the communities (especially those who bridge funds to other ecosystem) started realizing that Arbitrum is one of the best ecosystem with great DeFi infrastructure & innovations. Arbitrum TVL continues to stay at its ATH despite the crabby market, Arb token price recently incresed from $1.2 level to the ATH of $1.8

Besides the revival of Arbitrum Ecosystem, there are a few narratives that $GRAIL is capitalizing on

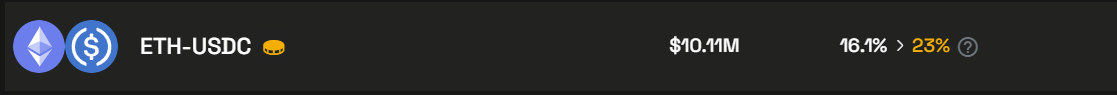

Real Yields - 2/3 of the APY that’s being generated is paid in the form of ETH-USDC LP

Concentrated Liquidity AMMs - Camelot partnered with Algebra v2, CLAMM Liquidity Solutions Provider that’s integrated across 11 major DEXs

CLAMM is a trending narrative as Uniswap v3 license expired earlier on April 2023 - DEXs work with liquidity managers and solution providers like Gamma Strategies, Arrakis Finance, Bunni (TimelessFi), Algebra, in providing an easy-to-use CLAMM features.

Interested to learn more on CLAMM? - you can check it out on this thread here that I wrote: https://twitter.com/LandfSmile/status/1646909004222963712

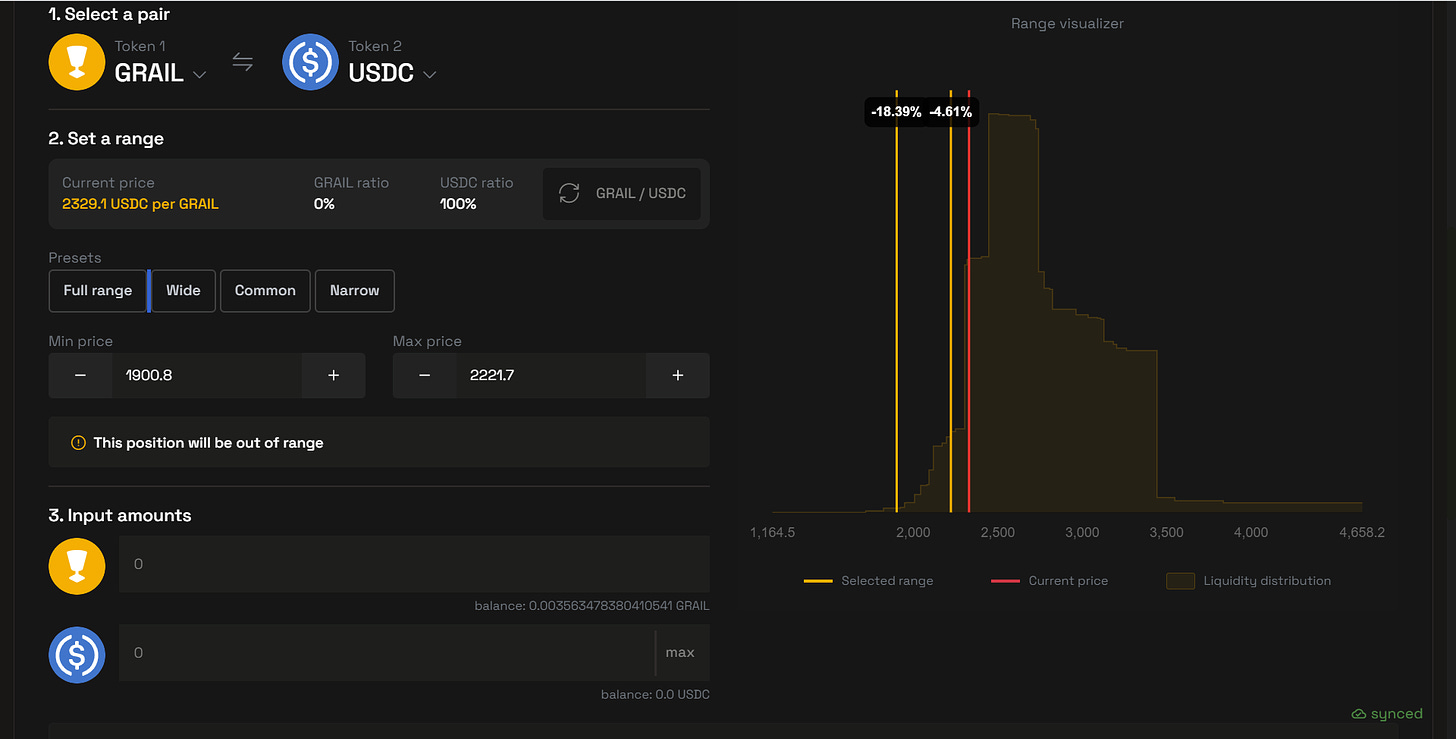

Camelot has already integrated its Camelot AMM v3 function where you can choose the range of LP you’d like to provide liquidity into

Camelot will soon launch more high-efficiency farms (details will be out pretty soon) Below is v2 vs v3 APY

Trade Execution

In anticipation of the crabby market and $GRAIL price consolidating between $2,100 - $2,300 level, we can utilize Grail v3 to provide targeted liquidity provisioning and slowly enter in position. For this, we need to provide single-sided staking with out-of-position LP in the lower value token e.g. if it’s GRAIL-USDC, single-side stake only USDC

25% of Size could be enter at the current Market Price while the rest 75% could be put as v3 LP

I’m expecting $1,900 support level to hold so we can set the LP range to be within $1,900 - $2,200 → the LP will act as limit order that’ll start generating fees and start DCA’ing into $GRAIL once the price falls into the range

Final Thoughts

With the aforementioned reasons, $GRAIL is #1 Liquidity Hub in Arbitrum. If you’re LONG Arbitrum, investing in $GRAIL serves as one of the best beta (correlation) plays as majority of projects that build on Arbitrum or migrated to Arbitrum would be partnering with Camelot.

Thank you for reading and hope you enjoy the article, feel free to let me know your thoughts, please like and subscribe my substack below