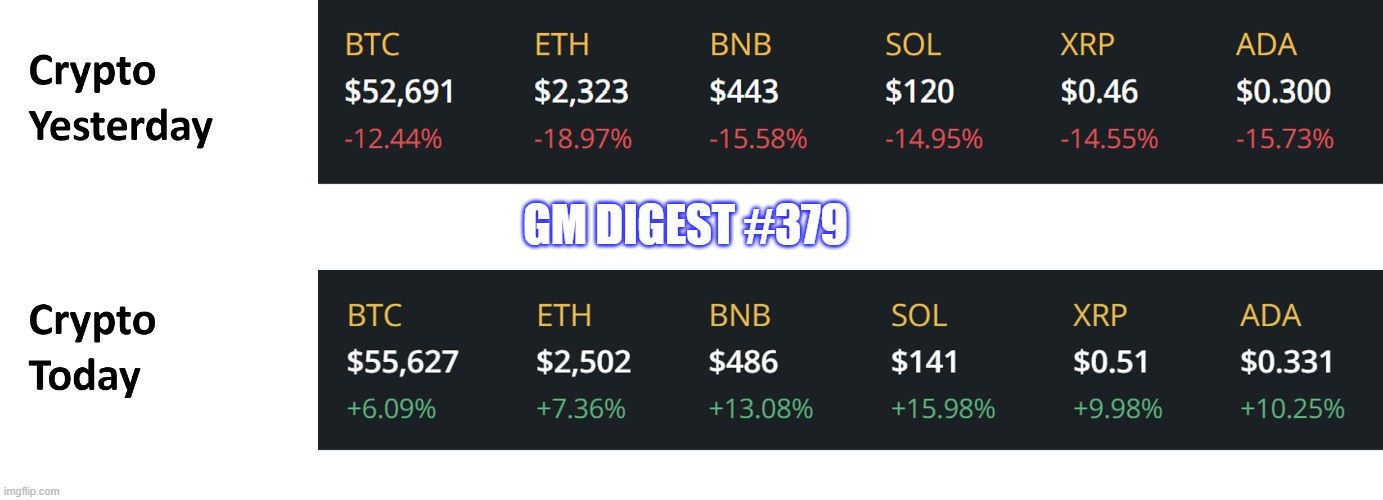

GM Digest #379 — Roller Coaster Market

Gm with Valuable Alphas / Insights — Make Sure to DYOR. All of This is Not Financial Advice. Ape at Your Own Peril

THORSwap’s RUNEPool

• RUNEPool is now live on @THORSwap, allowing users to deposit $RUNE and earn more $RUNE by providing liquidity paired with blue-chip asset pools

• Deposits in RUNEPool are distributed across multiple Protocol Owned Liquidity (POL) pools, reducing risk and maximizing yield potential by exposure to assets like BTC and ETH

• Key benefits include enhanced yield opportunities, reduced impermanent loss, and leveraging the Incentive Pendulum for large RUNE holders

• Users must lock their deposits for a minimum of 90 days and can earn yields from all enabled pools

Introducing Mansa

• @MansaFinance_co is a DeFi platform addressing the inefficiencies and high costs in emerging markets' finance by providing liquidity for multinational blue-chip companies

• It focuses on financing RWAs to secure stable yields unaffected by crypto market volatility

• Mansa aggregates liquidity to finance short-term receivables, benefiting businesses in these regions

• First pool launched on Base. LPs can earn yields and token rewards, with lower interest rates for borrowers. Initially, only whitelisted users can access the first pool on Base

Hawksight v2

• @HawksightCo has evolved from a yield optimizer to a LP aggregator for Solana memecoins and altcoins, generating $9.4M in fees and $5.8B in volume for Active LPers

• The platform is now launching an upgraded v2 DeFi app and rebranding, along with a new token launch and migration

• The Hawksight v2 DeFi app focuses on product-market-fit as an LP aggregator, solving major pain points for Active LPers. It provides analytics to track LP positions, discover trending pools, and analyze profitable strategies, while automating compounding, rebalancing, and Take Profit/Stop Loss triggers

• The app supports customized LP strategy automations for Orca CLMM and Meteora DLMM, qualifying users for $MET points

• The new token launch and migration address challenges from previous tokenomics. It rewards original users, tokenholders, and NFT holders, while also incentivizing new v2 users with airdrops

• The launch will be 100% on-chain with a low-FDV bonding curve, focusing on fair distribution without fundraising. Only currently circulating $HAWK tokens will be eligible for migration

• The Hawksight v2 DeFi app is set to launch in Q3 2024, followed by the new token in Q4 2024

Dojo x GMX

• @labs_compass has secured a grant to integrate @GMX_IO with its Python-based DeFi platform, Dojo

• Dojo simplifies DeFi interactions using Python commands, allowing users to focus on investment strategies without dealing with complex blockchain interactions

• Key features include secure on-premises deployment, scalable market access, advanced backtesting, and cross-protocol strategy development

• The grant will be used to provide easy access to GMX data, ensure a seamless integration of GMX into Dojo, and showcase demo trading strategies

Initia VIP

• @initiaFDN VIP introduces a new economic framework to make INIT the foundational asset of a multi-chain network of interwoven rollups

• VIP incentivizes use of INIT across L2s by distributing rewards every two weeks from a 10% $INIT supply pool, split into Balance and Weight Pools based on L2 token holdings and votes

• The Balance Pool rewards Minitias (apps) based on their use of $INIT, while the Weight Pool rewards them based on votes each epoch

• Rewards are given as $esINIT, which can be vested over time, or you can zap it into a 26 epoch locked INIT:ETH LP position

Introducing UniFi

• UniFi, @puffer_finance’s first rollup, aims to address Ethereum’s fragmentation by creating a unified ecosystem of interoperable app-chains

• UniFi will leverage Puffer’s validator network for decentralized transaction processing and yield generation

• Puffer's tech, including anti-slashers and Validator Tickets, support decentralized validation and revenue opportunities

• The native gas token will be $unifiETH, which enables users to earn yield and supports gasless transactions, promoting user adoption by subsidizing costs

The Grand Conquest

• @grandconquest is a fully on-chain MMO Grand Strategy game launching on the Berachain ecosystem, playable on the testnet

• Players cooperate and compete in a single on-chain game world via Chrome

• They recruit armies with Gold tokens, earn shares of the country's production, and expand territory to increase gold rewards

• They can also earn points for in-game actions that may convert into governance tokens, with potential for in-game airdrops as you level up

Introducing Lido Institutional

• @LidoFinance introduces Lido Institutional allowing institutions to participate in Ethereum staking

• Lido combines reliability and security necessary for institutional grade staking without sacrificing liquidity

• Lido Institutional is tailored for custodians, asset managers, exchanges etc.

Kujira Recovery Plan

• @TeamKujira announced their recovery plan which involves clearing debts and making changes to their protocol

• Firstly, the operational debt will be repaid via 2 individual PILOT sales to repay USDC and USK debt. This will clear the debt on the main GHOST position, & also convert the BOW leverage LPs into protocol owned liquidity. Community members with funds in the GHOST lend vaults the opportunity to participate if they wish to use their xAssets. Users’ rKUJI will be redeemable for $KUJI once the required balance is freed from collateral

• The structural changes and tokenomics terms will be decided on a later date

*Reminder to Size Your Entry for Degen Plays and Take Your Principal Out (Take Profits) Whenever You Hit Your Target*