Blur Fee Switch

• @SplitCapital’s proposal introduces a 0.5% protocol fee on trades, ending the current 0% fee structure, and plans to redistribute these fees to vote-escrowed $BLUR (veBLUR) token holders

• It also aims to strengthen its governance model by creating a fee council that can adjust fees based on market conditions

• Tokenomics will include two tokens: $BLUR for utility and $veBLUR for governance, with $veBLUR being obtained by locking $BLUR for up to four years, increasing voting power proportionally to the lock period

• $veBLUR holders will be rewarded with 100% of protocol fees each month and can vote on collections to boost rewards for specific NFTs. Blur has allocated 90 million $BLUR (3% of the total supply) for voter incentives in Season 4 and will discuss future rewards post-Season 4

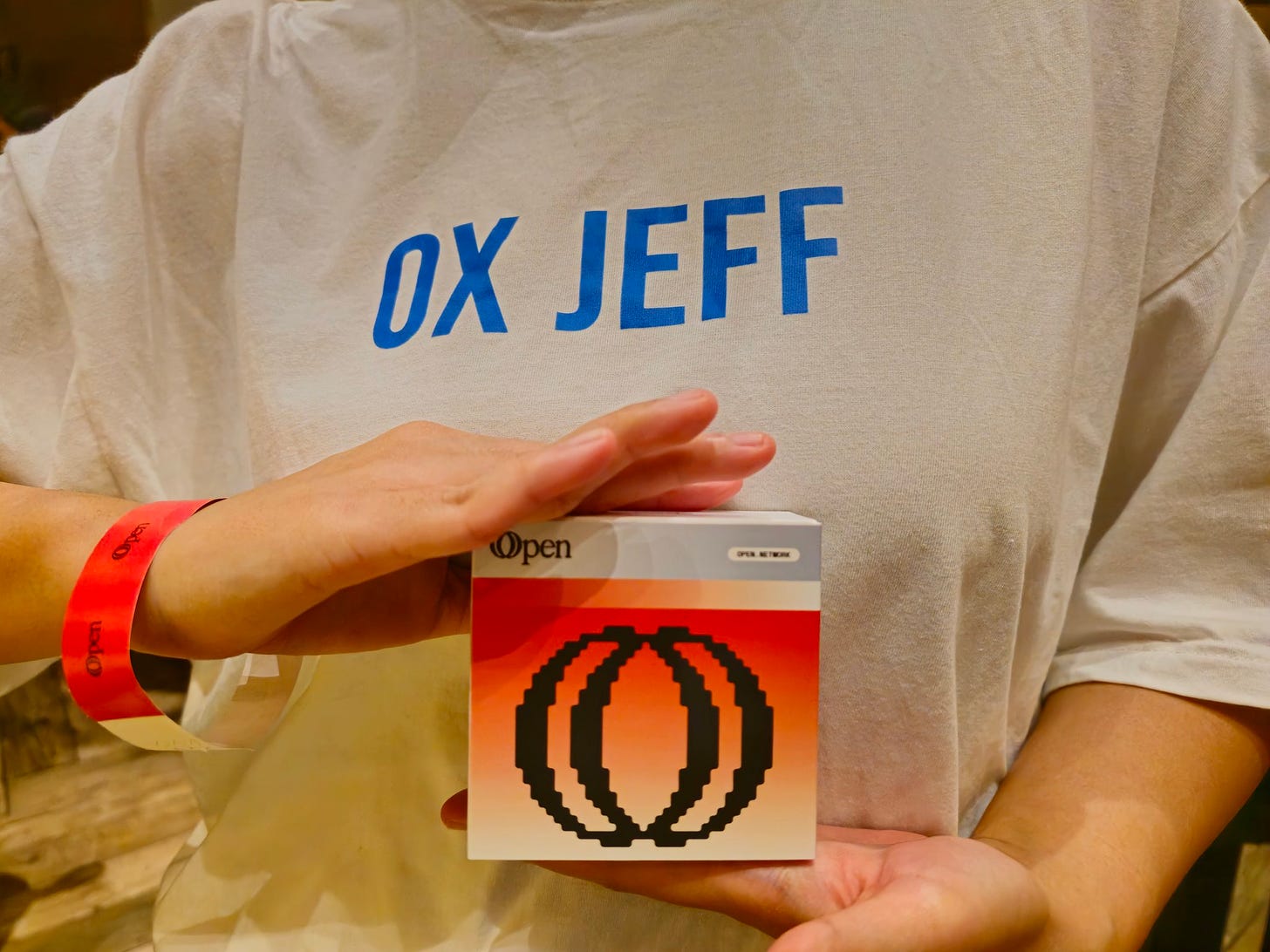

Introducing Open & Owlonmusk

• @webisopen is the merged entity of @RSS3_, RSSHub, and @openinfo_, aimed at advancing the Open Web through information and compute abstraction

• The platform facilitates open data access across Web1, Web2, and Web3, enabling developers to create diverse AI models and applications

• Its Open Virtual Machine (OVM) supports high-performance, verifiable computation on blockchain, catering to intensive applications in AI, DeFi, and scientific research. Open also enables scalable, community-driven monetization

• Currently they are running Open World I — ₮ⱧɆ ₳₩₳₭Ɇ₦ł₦₲, a game where users collectively train an AI called @owlonmusk_, which is designed for adaptive cognition. Participants in the game can earn rewards in the form of $OWLON tokens as they contribute to training the AI

Tempest Vaults

• @tempest_fi introduces AI-powered liquidity vaults designed to optimize returns on @ambient_finance

• Its Symmetric Vaults use machine learning to predict market volatility, automatically adjusting liquidity positions without swapping. Currently live for nine trading pairs. These vaults rebalance via limit orders to reduce costs and slippage

• Tempest also offers Arbitrage Vaults, starting with rswETH, which capture arbitrage profits during LST depegs, turning LPs into passive arbitrageurs. The Arbitrage Vaults deploy knockout orders to limit losses and redeploy funds strategically

Introducing scrvUSD

• @CurveFinance announced savings crvUSD (scrvUSD), a yield bearing version of its stablecoin allowing users to earn yield on their crvUSD

• scrvUSD is an interest bearing stablecoin giving users low risk yields derived from a portion of the interest paid by crvUSD minters

• Users who wish to earn yield from their stabelcoins can acquire crvUSD on the market and deposit it into savings crvUSD

LAIKA TGE

• @Laika_Layer2 announced that their $LAIKA token is live

• The team managed to raise $2m in 4 hours and have introduced their roadmap in the coming days/weeks which includes delegation and staking, governance, account abstraction, cross-chain swaps, CEX integration and liquid staking

• The team also announced some tokenomics changes where the vesting for oLAIKA is reduced and there is a reduced cliff period for the DAO

Introducing Linea Association

• @LineaBuild introduces Linea Association, dedicated to grow the Linea ecosystem

• The Association will be focused on supporting the development of the Linea mainnet, fostering decentralisation, enabling developers to build dApps and growing the community

• The Association also announced that they will be launching their token at the end of Q1 2025

Misc News

• @VenusProtocol adds $EIGEN as collateral on Ethereum

• @ArkhamIntel launches it’s own exchange for perp and spot trading