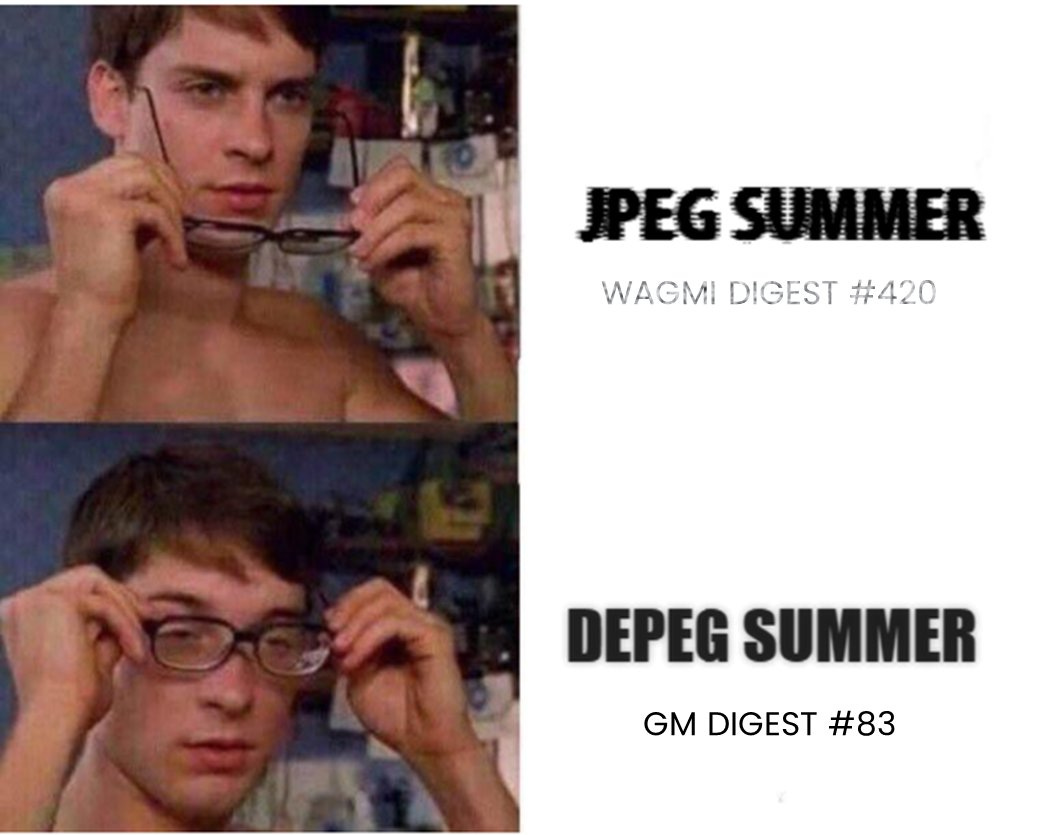

GM Digest #83

Gm with Valuable Alphas / Insights — Make Sure to DYOR. All of This is Not Financial Advice. Ape at Your Own Peril

USDR Depeg

• Real USD (USDR) — a stablecoin largely backed by real estate assets has depegged and is currently trading at $0.524

• This was after it was discovered that the DAI reserves backing USDR has been depleted. USDR is backed by real estate, DAI, Protocol-owned liquidity (POL), $TNGBL and an insurance fund

• The issue here was that the USDR backings were mostly illiquid real estate assets and the only stable liquid backing was DAI. Furthermore, the insurance funds consist of alt coins which means that the insurance funds and $TNGBL portion of the backing only consisted of risky assets

• Once users realised that the DAI backing was depleted, it meant that there USDR can no longer be redeemed for DAI and the backing only consisted of risky assets and illiquid assets backing it. This caused users to swap out of USDR causing the price to plummet

• The @tangibleDAO team responded to the incident and reported that USDR is 84% collateralised after marking $TNGBL and the insurance fund assets to zero. Redemptions will be available once the team launches Baskets — pools of yield-bearing tokenized real estate

• When redemptions open, USDR will be fully redeemable for a blend of stablecoins, basket tokens and locked TNGBL 3,3+ NFTs (TNGBL at market price, locked for one year). After redemption is complete, USDR will be depreciated

Scroll Mainnet is Live

• @Scroll_ZKP Mainnet is stealthily launched. Users can now bridge ETH to it by interacting directly with the smart contract or using @Owlto_Finance or @rhinofi

• No official announcement from the team has been made yet

Thoughts: Personally won’t bridge any funds and engage in degeneracy any time soon, especially when geopolitical risk roaming around. I’ll stick to Arbitrum for now

Chronos New Vision

• @ChronosFi_ has shared its vision for Chronos TAG & Chronos EON and how the ARB incentives (from ARB STIP ) will be distributed

• Chronos TAG → public infrastructure layer that will drive deeper liquidity and revenue at the lowest possible cost, driving in growth that will also be multiplied by bribe-for-emissions model

• Chronos EON → an on-chain intent-based derivatives trading platform that achieves remarkable increases in capital efficiency over existing vAMM-based products, 728x more capital efficient than GMX, 100% of fees from EON will be used to Buyback & Max Lock CHR

• Upcoming features will include Automatic voting rewards, fiat on/off ramp, cross-chain swaps, deploy new CLAMM tech, and more

Thoughts: Chronos EON is pretty interesting from an optics of capital efficiency & narrative / market sentiment. Intent-based architecture has been making rounds ever since Paradigm released their research on Intent-based architectures & their risks. Suggests reading it here if you haven’t already

ParaX AI, Intent-based LLM

• @ParaX_ai unveiled the first Web3 intent-based Large Language Model (LLM)

• This LLM will act as an AI assistant for Web3 users, enabling users to query specific intentions into actionable requests that are triggered through the ParaX platform (Cross Margin Lending Protocol with AA on Multichains — $180m TVL)

• Once a user’s intent is recognized, ParaX AI will generate responses with corresponding transactions needed to finalize the query

• For example, if a user has trading needs on Uniswap and borrowing needs on Maker, they can combine these requirements using this approach. Even if users lack a clear understanding of related knowledge, operational pathways, or risk awareness, ParaX’s AI can assist users in automating the execution of these operations and requirements

Thoughts: This will simplify many of the processes for newcomers in the Defi space but one question lingers in my mind… How do you train the AI’s knowledge base to be vast & competent enough to execute more complex intent in the most efficient way possible?

Stars Arena Exploiter Responds

• The @starsarenacom hacker sent an onchain message saying: “I would like to cooperate”

• The team officially updated that they have recovered 90% of the lost funds in exchange for a 10% bounty fee and an additional 1000 $AVAX that was lost in a bridge. The team recovered a total of 239,493 AVAX and offered 27,610 AVAX to the exploiter as a rewards

Thoughts: Seems to be the best outcome that could come out of this exploit, ramped up security / full contract audit with 0xPaladin. Gap has been filled and Stars Arena is ready to get into the arena again. SocialFi is currently still dominated by Friend Tech and followed by Cipher which recently got more popular due to the shoutout by Arbitrum Foundation + new features + the fact that it’s super close to token/airdrop launch. Will be interesting to see how the SocialFi sector unfolds after Stars Arena relaunch

Aperture UniSwap Tools

• @ApertureFinance offers two products: ApertureSwap, a concentrated liquidity DEX on Manta Pacific L2, and UniV3 liquidity management tools

• Aperture's liquidity automation tools are now live on all major chains where @Uniswap is present. This set of tools basically enables limit orders, compounding, and automated repositioning of lp ranges on UniSwap

• Aperture launched a liquidity mining program ApretureSwap at the start of the month and is still in phase one. 0.5% of total $APTR token supply will be distributed to lps in this period.

Mars V2 Deployed

• @mars_protocol announced Mars V2 is officially live on @osmosiszone

• Credit Accounts (Rovers) are containers that can hold all your assets and loans, including LP tokens and margin trades. You can then utilize all these bundled-up positions as collateral to borrow from the Red Bank, enabling you to leverage, yield farm, hedge, margin trade, etc. ‘Rovers’ are great because they unlock liquidity and enable a variety of strategies to be implemented

• Each Rover (Credit Account) is minted as a transferrable NFT and all assets inside are cross-collateralized. Meaning it has a single liquidation point that you need to be mindful of

• Mars Protocol is a lending and borrowing market in the Cosmos ecosystem that was originally launched on Terra

Thoughts: Mars was originally on Tera and launched its TGE with Lockdrop (This is one of the place where I locked my UST and lost them during the crash). Since the crash, Mars has moved from Terra to Cosmos eco. Mars credit account works in a similar fashion to Defi prime brokerages where defi primitives are whitelisted on the brokerage — In Mars case, users can spot trade, margin trade, farm, lend & borrow, leverage defi strats, all in one credit account. Personally have not had a chance to try this out, not sure what’s the composability of this vs Gearbox or other defi prime brokerages. Since this is on Cosmos, I’m also not sure if you’d be able to use MetaMask to access (even though recently MM partners with Squidrouter for Cosmos integration)

Blueberry Protocol New Mint on Sunday

• @blueberryFDN is a protocol that enables the on-chain integration of risk-free treasury yield

• Users have the opportunity to mint TBYs twice a month, and the next minting window will open in 4 days

• TBYs (Term Bound Yield) are tokens issued by the Bloom smart contract that generate yields similar to a 6-month treasury bill. Here's how it works: Within a 3-day window, you can commit USDC. Once the execution phase is complete, you receive TBYs. Each TBY has a duration of 180 days from the time of execution. Upon maturity, you can redeem them for the principal amount plus interest

Prime Protocol X LayerZero

• @prime_protocol is DeFi’s first natively cross-chain prime brokerage. Deposit any asset from any chain on Prime, and borrow any other asset on any other chain backed by the total value of your account

• Prime currently supports 8 different blockchains, including Arbitrum, Avalanche, Base, BNB Chain, Ethereum, Moonbeam, Polygon, and Optimism

• Adding LayerZero to Prime will enable the protocol to handle a higher volume of transactions and allow for an easier onboarding process through faster deposits, ensuring that the protocol becomes more accessible to a broader crypto audience

• Currently Prime has over $5m in TVL across the chains mentioned with majority of the TVL residing on Moonbeam ($3.3m)

Silo X Pendle

• @SiloFinance announced that $crvUSD deposits to 'Silo Llama' $CRV market were added to @pendle_fi

• The move is expected to enhance lending liquidity for $crvUSD and offer Silo users opportunities for yield trading

• Additionally, they have recently resumed conducting buybacks as part of their program to acquire tokens using DAO revenue. These tokens are then utilized to incentivize the usage of the Silo protocol

• Silo Finance is a lending and borrowing protocol that offers risk-isolated money markets(silos) on Ethereum & Arbitrum

Thoughts: Both Pendle & Silo have passed their quorum. Both got “Yes” and Silo will receive 1m ARB allocation to be distributed across its lending markets. This is mainly done to stimulate deposits and utilization of existing markets. Silo v2 is coming soon that’ll keep the siloed architecture while improving capital efficiency & the variety of assets, and will introduce veSILO tokenomics that’ll align the interest of long-term supporters with the protocol. $SILO has pumped 100% from its recent low during the end of September (along with other Arbitrum alt coins) but has since then retraced by 15% because of the overall market environment.

Misc News

• Circle rolls out native USDC on Polygon

• Prime Protocol integrates with LayerZero

• @TraderJoe_xyz launches Arbitrum Adventure. A three-week quest campaign hosted on Galxe with a prize pool of 50k

• @ArkhamIntel data now available via @chainlink

• @starsarenacom team develops a brand new smart contract, audited by @0xPaladinSec

• @tangibleDAO’s real-estate-backed stablecoin $USDR, has experienced a de-pegging event

• More than 50% of Hong Kong retail crypto investors are unaware of the relevant regulations in place

• Galxe announces $396,000 refund to affected users following DNS attack

• @MetaMask announces that US users will now be able to on-ramp to crypto using @stripe

• LayerZero live on opBNB

• @Platypusdefi on AVAX has been exploited for ~$1m. The team has suspended all activities on all the pools

• @skydrome (First Solidly Fork on Scroll) introduces $SKY Pre-Mining Campaign on Scroll. 3% Supply distributed from Oct 12 - Nov 2

• Introducing @RioRestaking new liquid restaked token built on top of EigenLayer (Not much info out yet)

Arbitrum Picks of the Day (Unlaunched tokens)

• $TIME @TimeswapLabs — First Oracleless lending & borrowing protocol in DeFi that enables permissionless creation of money markets for any ERC-20 / ERC-4626 token pair in a secure manner (Uniswap for Lending & Borrowing)

⇢ 200k ARB grant received, $TIME pre-mining will start soon which will likely be very attractive because of the ARB incentives & $TIME rewards

• $VRTX @vertex_protocol — a cross-collateralized order book DEX with unified margin across spot and perps trading on Arbitrum. $9m in TVL and over $2bn traded in the last 30 days

⇢ 1.8M – 3M ARB ARB grant received based on Trading Volume & LP demand from Elixir Protocol. Elixir’s protocol will be powering Vertex’s upcoming “Fusion Pools” product, allowing users to supply USDC collateral to build up the orderbooks of perpetual futures as well as spot pairs on the exchange

*Reminder to Size Your Entry for Degen Plays and Take Your Principal Out (Take Profits) Whenever You Hit Your Target*