GM Digest #88

Gm with Valuable Alphas / Insights — Make Sure to DYOR. All of This is Not Financial Advice. Ape at Your Own Peril

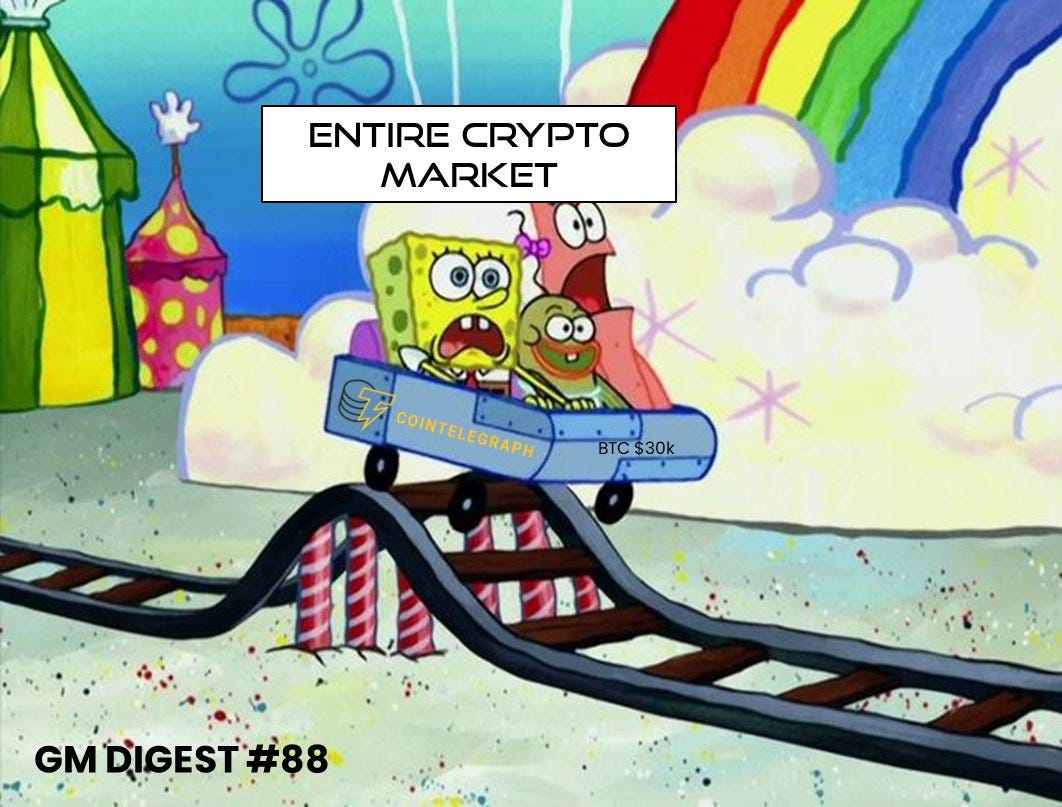

Cointelegraph Shenanigan

• @Cointelegraph made BTC and the entire market go up for 15 mins yesterday. BTC went up 10%, hitting $30k for the first time in forever

• Cointelegraph reported that Bitcoin iShare ETF was approved by SEC → Market Pumped Hard → 15 mins later BlackRock confirmed that it’s fake news → We’re Back (Down) Again

• To ensure that something like this does not happen again, the Cointelegraph team is thoroughly auditing and reviewing our social media management processes, especially around the authentication of breaking news before a post can be published

• Entire market still up with BTC & ETH up by 1.9% & 0.9% respectively

Thoughts: If fake news can take us this high, imagine when the real news come that will be accompanied by a wave of Bitcoin ETFs. This serves as a reminder to position yourself & accumulate because nobody will know when the bull market hits

Gravita Ascend

• @gravitaprotocol is an Ethereum-based borrowing protocol that offers interest-free loans secured by both LSTs and a Stability Pool

• They just announced their points program called 'Ascend' in which you will be able to earn 'Marks' by completing various tasks on the protocol

• The tasks involve opening up and maintaining a 'vessel', which is basically a vault where you deposit your collateral and use it to borrow $GRAI against (the protocol's native stablecoin). Or, require you to deposit $GRAI in the stability pool which earns yield from liquidating vessels and helps maintain $GRAI backing

• The protocol currently has $34M in TVL, which has steadily increased since its launch, all without the use of token incentives

Thoughts: They are in the process of deploying to ZkSync, Polygon zkEVM and Base which is neat because while farming Ascend 'Marks', you will also have the potential to earn L2 airdrops. Users can earn from 5% to 18% on GRAI stable pairs LP on Ethereum, Arbitrum, and Optimism

The Soar Experiment

• @TheSoarTheory is an experimental concept that aims to generate positive price action by introducing the idea of liquidity rebuying

• The ponzinomics of this protocol are centered around the following concept: In regular AMMs, when you buy X token with ETH, X goes to your wallet while the ETH is added to the pool. This causes a change in the X-ETH ratio, ultimately resulting in an increase in token price

• With Soar's Liquidity Rebuying twist, when the $SOAR token is purchased with ETH, the ETH is not added to the LP. Instead, the ETH is set aside, and an equivalent amount of $SOAR tokens is removed from the LP and burned. Then, at a certain randomized block, all the accumulated ETH is used to buy back and burn more $SOAR tokens

• The concept is to amplify the buying pressure. When you make a single ETH purchase, it generates buying pressure equivalent to 2 ETH, and so on

Thoughts: When their native token $SOAR was initially seeded, it had a modest market cap of 6k. However, thanks to the rapid liquidity rebuying mechanics, it quickly surged to a market cap of 20m (a quick green wick) upon launch, burning 50% of the total token supply in the process. However, as the rebuying activity outpaced the growth of liquidity depth, adjustments needed to be made. Consequently, they increased the allocation percentage to liquidity in an effort to align liquidity depth with the rebuying mechanics. Hopefully, the upgrades result in more balanced and sustainable growth. Extremely Degen play

Hashless Expands to BNB

• @proofofanon provides a toolkit for enhanced anonymity, offering two products: Koms and Hashless

• Hashless is a mixer tool that provides anonymity to blockchain transfers. It is currently available on Ethereum and, as of yesterday, on the BNB chain as well

• Koms is an L2 chatbot for Telegram that offers the ability to encrypt usernames and conversations. To enhance privacy, it utilizes TOR routing to further obscure the identities of both the sender and receiver

• In addition to the BNB expansion announcement, they have also unveiled a 100% revenue share from Hashless for all $PRF token holders. The token carries a 5% buy/sell fee, and its current market cap stands at $1M. They also have an NFT collection called 'The Leaders' that gets a 2% of the roundtrip taxes

Lido on Solana Sunsets

• @LidoFinance announced that they will be sunsetting Lido on Solana after a community vote

• Users will still be able to receive staking rewards throughout this sunseting process and users have until February 4 to unstake their stSOL via the frontend. As of today, no new stake will be accepted

• For node operators, operators who decide to exit the pool will be able to shut down their nodes following the off-boarding and operators who stay will maintain their remaining stake on their nodes

Thoughts: Since Lido is the 3rd largest liquid staking provider on Solana, over $50m of liquid staked SOL TVL will need to migrate to other solutions, Jito & Marinade Finance could be the main recipients of these TVL with each of them offering 7% & 8% APY respectively

Myso Finance

• @MysoFinance announced that their V2 is live on Ethereum. MYSO v2 is a trust-minimized lending protocol implemented on the EVM that enables Zero-Liquidation Loans (ZLLs), which are crypto-collateralized loans without liquidations

• For borrowers, they are able to borrow assets with no liquidation risk, no counterparty risk and transparent loan terms

• Lenders have full control over the markets they create and the loan structure. Lenders are able to customize each loan with a unique LTV, tenor, and fee structure and accept different types of collateral from a single lender vault

Ether.fi Updates

• @ether_fi announced that they will be launching eETH within a month. eETH will be the first LST that is natively restaked on @eigenlayer

• The team also announced that they will be committed to self limiting their stake to a number of validators and ETH to below 25% of the consensus layer

Misc News

• @Rabby_io releases Rabby Desktop client

• @MantaNetwork reveals Manta Pacific Roadmap, opts for Polygon CDK over OP Stack

• @Uniswap will implement a 0.15% swap fee for specific tokens

• @Cointelegraph clarifies misleading Bitcoin ETF tweet

• @binance will stop accepting users in the UK as of Oct 16

• @Vaultkaofficial WL Round IDO gone in a flash. Second Round (Overflow) is already at 600+ E, overfilling the cap of 500 E

• @vector_fi x LayerZero with zJOE, automating the yield farming process across chains

• OKX Ventures invests in @CelestiaOrg

• TrueUSD third party security breach revealed wallet addresses of clients

• Binance to temporarily stop accepting new UK users after FCA restriction

• @MetaMask introduces Metamask Snaps

• @CieloFinance announced a wallet PnL feature

Jeff’s Betting Shenanigan

• Jeff has started betting on @SX_Network (#1 Web3 Sports Betting Platform)

• Jeff doesn’t watch sports cause he’s a nerd and he used to watch only eSports but now there’s no Dota 2 TI but there’ll be LoL World soon which Jeff will be participating in his betting shenanigan

• For now, seeing how BTC moves up drastically to $30k yesterday and stayed at $28k level which is higher than previous days, Jeff decided to bet on BTC going below $27.8k (Oct18/23)

• Jeff has bet $300 with 4.66 odds with potential $1,076 returns if he’s right (We shall see tomorrow)

Upcoming IDO / TGE

• Dip Exchange $DGT Dutch Auction conducted with Bounce.Finance on November 1st 2023 2pm UTC. Dip Exchange is a GMX fork on Base that utilizes Level Finance Debt Tranche LP system. $DGT gets 10% protocol rev share

• Root TGE October 28th with Seneca (One of the stems) launching its first Public Raise soon

*Reminder to Size Your Entry for Degen Plays and Take Your Principal Out (Take Profits) Whenever You Hit Your Target*